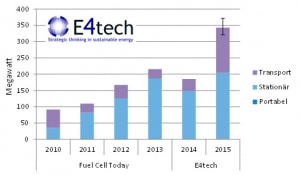

The number of 70,000 delivered fuel cell systems was only a slight plus compared to the two previous years. Still, the output in megawatts almost doubled compared to the year prior (see figure 2). The 2015 numbers include a forecast for the last months of the year, so that there is a certain margin for error as shown with the figures. The uncertainty in market development mainly stems from the introduction of new USB chargers – especially by MyFC – at the end of the year as well as the dynamic growth of the fuel cell car market.

FuelCell Energy, Bloom Energy – and in 2015 increasingly Doosan Fuel Cell America – were dominating stationary fuel cell applications based on the output supplied. The latter was able to snatch up large orders especially in South Korea. Additionally, the number of mini CHP plants (fuel cell heating systems) continues to grow under the Japanese ENE-FARM program.

The strong megawatt growth in the transportation segment is primarily a result of Toyota’s market introduction of the Mirai and rising sales of Hyundai’s Tucson ix35. The strong numbers are no surprise considering that ten fuel cell cars already constitute an output of one megawatt. In addition to 1,000 new fuel cell cars planned in 2015, fuel cell range extenders were playing an increasingly important role for powered industrial trucks in France (see France’s Own Energy Transformation). In terms of quantity, fuel cell industrial trucks are still dominating the transportation segment, where Plug Power has reported increasing sales. In 2016, the field will widen, as Nuvera – which was taken over by NACCO Materials Handling – enters the arena as a new competitor with ambitious plans for the market of fuel cell forklift trucks.

The expectations nourished in the past regarding portable fuel cell systems like USB chargers could not be fulfilled. The launch of new products by MyFC from Sweden and eZelleron from Germany gives hope to rising numbers in this segment in 2016. What continued its success story in 2015 were mobile or portable fuel cell devices for off-grid power supply in the leisure market (e.g., camping) as well as for measurement and control systems and other industrial applications. The same was true for portable fuel cells for military use, especially in the US.

Cautiously optimistic outlook on 2016

Despite the strong growth in 2015, the fuel cell market still largely relies on direct and indirect subsidies. This includes especially the Self-Generation Incentive Program in California and the Renewable Portfolio Standard in South Korea. Even the Japanese market for fuel cell heating systems and its more than 150,000 installed units are not a guarantee for growth without further financial assistance. Expectations are that the subsidies there will continue. European manufacturers of fuel cell heating systems may get the long-awaited market impetus from the German subsidy program for the market ramp-up of fuel cells, scheduled for the beginning of 2015. But one will need to wait and see whether the number of systems subsidized will be sufficient to reach competitive cost ratios over the medium term.

Special markets, in which fuel cells have already stopped relying on subsidies (e.g., powered industrial trucks and off-grid or grid-supporting systems) are expected to continue their upward trend. Thanks to a special fuel cell bus subsidy, China could already and all of a sudden become the leading market for this technology in 2016. Not least thanks to Toyota‘s time-consuming ad campaign, certain fuel cell cars were all over the headlines of industry magazines in 2015 and simultaneously sparked a change in the fuel cell industry whose impact could be felt throughout the market. Carmakers cannot expect to make money with fuel cell cars over the coming years. But they will help introduce the technology to the markets, so they have something up their sleeves in the face of ever stricter emission limits.

The full report with supply figures, data tables, analyses and comments is available for free at: www.FuelCellIndustryReview.com

References: D. Hart, F. Lehner, R. Rose, J. Lewis; The Fuel Cell Industry Review 2015. Nov. 2015

Authors: Franz Lehner, David Hart

Both from E4tech, Lausanne/Switzerland

0 Comments