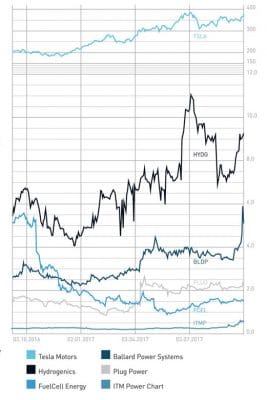

A second-quarter loss of USD 1.2 million or USD 0.01 per share is one thing, but a more than 50 percent year-on-year jump in revenue to USD 26.1 million is quite another. Canadian-based Ballard (Nasdaq: BLDP) managed to push the gross margin to 38 percent, so that earnings before interest, taxes, depreciation and amortization were at positive USD 1.1 million. That’s plus USD 0.4 million through the first half year. Revenue grew by 45 percent to USD 49.2 million during the same period.

The stock market has meanwhile rewarded these good second-quarter results with higher quotes. It was the first time in the company’s history and – as Ballard said – the first time for a fuel cell business worldwide to end a quarter on a positive EBITDA. This leads me to predict that we will see the company in the black (regarding earnings) for more than just these three months. Cash and cash equivalents added up to an impressive USD 68.1 million. CEO Randy MacEwan expects an excellent outlook in all business areas and target markets: “We’re well positioned to deliver a strong second half; we have a record order book and robust sales pipeline.”

Particularly China is stepping on the gas. Broad Ocean – a large Ballard customer and shareholder – upped its already ambitious growth forecast another time. And representatives from the PRC’s biggest port operator are looking for someone to purchase around 60,000 tons of hydrogen per year and have been in talks with the Canadian business about a possible agreement.

Stack production started in China

The production of fuel cell bus stacks in cooperation with Guangdong Synergy – 6,000 per year in 2017 and likely 20,000 in a few years’ time – began after the manufacturing facilities were inaugurated on Sept. 5. The first stacks were produced for purposes such as testing and quality assurance. Output will be ramped up throughout the rest of the year to a three-shift cycle on five days a week. It would be interesting to know what Ballard generates in revenue per stack and which margin it receives. I don’t know the actual figures, but I bet they are something like USD 10,000 to 30,000 at 10 to 30 percent per stack. You can easily see what that would mean.

The demand is definitely there. Ballard has been cooperating with 13 bus manufacturers on 13 projects. China grants RMB 1 million in subsidies for each electric bus equipped with batteries and/or fuel cells and one of its cities, Shanghai, pays RMB 1.1 million. That’s around 50 percent of today’s prices for these types of buses. Since the grants for battery-only versions will be cut by 20 percent by the end of this year, fuel cell buses are becoming the more attractive option.

Europe slowly pushes forward – USA falls behind

In Europe, fuel cell bus deployment is reaching the bidding stage. The initial target is said to be 291 vehicles, for which Ballard believes it has a good chance to be chosen as a stack supplier. Additionally, metropolitan areas such as London have launched a series of initiatives to replace their entire public fleet of buses. In the States, the situation is a bit different. There are plans by individual communities and businesses – such as L.A. Metro, which intends to get 200 fuel cell buses on the road by the end of 2019 – and some states, such as California. But there doesn’t seem to be widespread awareness of the fuel cell’s potential, although the specifications – 20 hours continued use at a radius of 250 miles or 402 kilometers – provide a strong argument in favor of deployment. It was said during Ballard’s conference call that the United States were at risk of falling behind in commercial-stage applications.

Protonex disappoints – at the moment

Ballard’s subsidiary Protonex, which manufactures drones and other equipment, has so far not fulfilled expectations. But the company’s outlook lets one imagine it to have a great future. It was said during the call that Protonex had reached a critical turning point in fuel cell growth, which was a reference to the bids for supplying the U.S. Army with the technology. It would take a long time until contracts could be awarded because of the many checks that need to be run first. While all of this means that progress will not be made as fast as one would like, things will definitely advance – still in 2017, I believe. Besides Boeing, Protonex also has another – still unnamed – big-league customer. And it was revealed that it had been in negotiations or informal talks with a big logistics company or a company with a large logistics operation. I’m just speculating here, but this potential customer could be Amazon. The corporation has already been collaborating with Plug Power and indirectly with Ballard, which delivers stacks to Plug.

Materials handling – another partnership in sight

Through its subsidiary GenSure, formerly ReliOn, Plug Power has set up its own fuel cell stack production and has ordered an ever fewer number of stacks from Ballard, as you can glean from looking at the relevant revenue figures. Ballard, on the other hand, has been involved in Plug’s forklift retrofit project since the beginning, which has given it unfettered access to the outcomes of the stack research. I think that the cooperation will continue to a lesser degree, but will soon be a lower priority for Ballard. Indeed, parts of the call transcript could lead you to believe that the Canadian-based business could soon win over another, possibly much bigger partner for stack use in logistics. My bet is on Toyota Tsusho, with which it is collaborating closely without having provided any details on their agreement (potential contract values). With nearly USD 80 billion in revenue, the Toyota subsidiary is, for example, the world’s leading forklift truck manufacturer. Should Ballard go down this route, I think it would create better supply opportunities for fuel cell stacks than the ones Plug could provide, despite the latter’s sale of 15,000 systems to date.

Risk warning

Investors must understand that buying and selling shares is done at their own risk. Consider spreading the risk as a sensible precaution. The fuel cell companies mentioned in this article are small and mid-cap ones, i.e., they do not represent stakes in big companies and the volatility is significantly higher. This article is not to be taken as a recommendation of what shares to buy or sell – it comes without any explicit or implicit guarantee or warranty. All information is based on publicly available sources and the assessments put forth in this article represent exclusively the author’s own opinion. This article focuses on mid-term and long-term perspectives and not short-term profit. The author may own shares in any of the companies mentioned in this article.

Author: Sven Jösting, written September 8th, 2017

0 Comments