At the dawn of the new millennium, the shares of fuel cell companies had gone through the roof. Fuel cells were thought of as the next big breakthrough technology, and it seemed as if large, new growth markets were just waiting to be exploited. But shareholders were mistaken, celebrating too early. The industry’s leading businesses stumbled over the immense cost to develop and introduce new technologies. Likewise, a lot of them were spread too thin, trying to serve too many markets with too many products at once. Instead of concentrating research on a few promising segments, some allocated resources to several – regardless of their potential.

Millennium Cell, an American business founded in 1998, was one of those businesses said to have a bright future. With the development of intriguing fuel cell technologies, for example, to power drones, it became worth billions of dollars before tumbling to rock bottom and into bankruptcy. However, Millennium Cell’s rise and fall didn’t put a stop to the market altogether. Others had no doubt about their success either, but they were clever enough to focus research on a few markets to become a force to be reckoned with.

Here’s the irony: Two businesses that had worked together closely during that time were Millennium Cell and Protonex. While the former has gone bankrupt, the latter has become a wholly owned subsidiary of Ballard Power.

15 years to breakthrough

It was to take about 15 years before the industry’s stakeholders felt sure enough in 2017 that the fuel cell had again grabbed the attention of the market. They believe that the technology could soon prove to be a vital asset in meeting global demand for electricity, heat and cooling, and energy in transportation, for example, to power private and commercial vehicles, trains and ships.

According to futurist John Naisbitt, the time’s ripe for a new direction. On average, it takes 15 years for a megatrend to emerge. There will be highs and lows, but the core message will remain: “The trend is your friend.” What may have given the fuel cell its new – and especially, long-term – prospects were developments in electric transportation, but also rising oil prices and the discussion about carbon dioxide emissions and climate change.

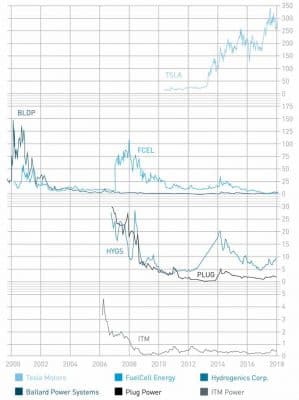

There has been a shift in the mindset of investors, although it may still take a while to persuade them of the technology’s rosy outlook. Most fuel cell businesses have lost a considerable portion of their market value over the years, some up to 99 percent. Research and development have made capital raises at unfavorable terms a frequent occurrence, which has diluted the stock of existing shareholders. For example, Ballard Power, currently valued at USD 5, would need to grow by 2,000 percent to regain the USD 120 footing it had in 2000.

Still, it is becoming increasingly clear that all those years spent on researching system designs and finding ways to produce and store hydrogen will be paying off, a development that is certain to have a positive impact on stock market prices. As soon as the new megatrend takes off, there will be no holding back, as everyone will want their piece of the pie.

Industry experts such as Toyota’s chairman and inventor of the Prius, Takeshi Uchiyamada, see 2020 as the dawn of the fuel cell age, particularly in transportation. Other experts go as far as to say that from 2020 on, the technology will show growth akin to the 1990s boom in the solar and wind industry.

Risk warning

Share trading can result in a total loss of your investment. Consider spreading the risk as a sensible precaution. The fuel cell companies mentioned in this article are small and mid-cap ones, i.e., they may experience high stock volatility. This article is not to be taken as a recommendation of what shares to buy or sell – it comes without any explicit or implicit guarantee or warranty. All information is based on publicly available sources and the content of this article reflects the author’s opinion only. This article focuses on mid-term and long-term prospects and not short-term profit. The author may own shares in any of the companies mentioned in it.

Written by Sven Jösting in December 2017

0 Comments