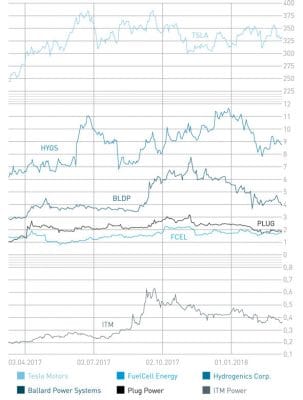

Technological breakthroughs and rosy prospects for growth may have raised expectations of the fuel cell companies described below, but their grossly undervalued stocks haven’t followed suit. Zooming out for a moment, there should be a greater focus on sustainability if the goal is to up the stock price. Instead, too much emphasis is placed on current financial results, specifically on the reports published each quarter. A pessimistic view of the next two years seems especially unjustified considering that sectors such as electric transportation are making increased use of both fuel cells and hydrogen and that manufacturers of these technologies are starting to give battery producers a run for their money. The countries leading the charge are China and Japan.

Plug Power (Nasdaq: PLUG) has moved into a strong position on the forklift truck market. Many A-list customers have come to rely entirely on fuel cells and signed impressive multi-year contracts for more than 19,000 hydrogen-powered forklift trucks and 15,000 hydrogen fill-ups per day. Plug is also designing fuel cell systems for courier vans and is pushing into China, which is not an easy task, I might add. It has asked Barclays Bank for help in finding suitable partners to gain a foothold in the Chinese market.

One positive piece of news is the United States’ extension of the 30 percent investment tax credit (see p. 60) and the continued financial support for fuel cells. Considering these developments and the statements by CEO Andy Marsh, I could see Plug expecting one of this year’s quarters to exceed USD 50 million in revenue and reach a positive EBITDA. In 2017, revenues added up to USD 130 million. In 2022, the figure is said to grow to more than USD 500 million, two years later than had been predicted earlier.

Enthusiastic McKinsey consultants

What’s clear is that the global fuel cell market shows strong and sustained growth. McKinsey puts the investment in fuel cell technology at more than USD 275 billion in the coming years. It added that the global market for fuel cells, including hydrogen production, could reach USD 2.5 trillion in size in 2050. Regarding forklift trucks and material handling equipment, McKinsey sees fuel cells beating batteries by a mile and a half in the long term.

…

Risk warning

Share trading can result in a total loss of your investment. Consider spreading the risk as a sensible precaution. The fuel cell companies mentioned in this article are small and mid-cap ones, i.e., they may experience high stock volatility. This article is not to be taken as a recommendation of what shares to buy or sell – it comes without any explicit or implicit guarantee or warranty. All information is based on publicly available sources and the content of this article reflects the author’s opinion only. This article focuses on mid-term and long-term prospects and not short-term profit. The author may own shares in any of the companies mentioned in it.

Written by Sven Jösting, February 2018

0 Comments