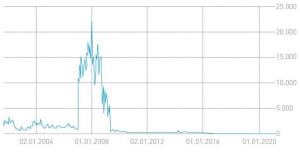

There has been a stark rise in the valuation of the business from around USD 100 million to now over USD 9 billion, with the stock price increasing from USD 1 – USD 2 to USD 29. I would go so far as to call it totally excessive. I got early wind of FuelCell Energy [Nasdaq: FCEL] as a turnaround after a management consultancy had “cleaned it up” and after the company had undergone a period of refinancing and restructuring and happily onboarded Orion Energy Partners as a key investor.

The current figures do not bear out this valuation: In the fourth quarter of the fiscal year 2020, as at Jan. 31, 2021, revenue increased to USD 17 million, a rise of 54 percent, yet there was a loss on shares of USD 0.08 apiece. Orders on hand dropped slightly by 2.9 percent to USD 1.39 billion.

Traders fuel stock price fluctuations

With daily volumes of traded stocks frequently exceeding 100 million, it’s got me thinking. And it leads me to conclude that this activity is due to a mixture of day and momentum traders as well as the swarm-like behavior of “neo-brokers.” Purely from a valuation standpoint, its competitor Bloom Energy looks more interesting, in my subjective view. A rethink would, however, be valid if FuelCell Energy generates significant new orders for its fuel cell power plants in addition to its proprietary carbon capture technology. Until that happens a new investment does not make sense, unless you consider yourself a day trader since there is still considerable volatility in prices. For those who know how to skillfully leverage this there is some money to be made – and on a daily basis.

Rounding up, if the company can noticeably increase its orders on hand and has the skills to broaden the reach of its own carbon capture technology, for instance through license agreements, then a rethink will be called for. A merger or takeover of the business is quite possible too, since there is no anchor shareholder yet; also should Orion Energy Partners withdraw from the partnership then the investor will be reeling in its credit line. A “strategic investor” could change the landscape but in valuation terms Bloom Energy is, for me, better positioned. An analysts’ event held by U.S. broker Canaccord with representatives from Bloom Energy and FuelCell Energy will supply more information on the differentiation between the two companies. I’ll report back.

Risk warning

Share trading can result in a total loss of your investment. Consider spreading the risk as a sensible precaution. The fuel cell companies mentioned in this article are small- and mid-cap businesses, which means their stocks may experience high volatility. The information in this article is based on publicly available sources, and the views and opinions expressed herein are those of the author only. They are not to be taken as a suggestion of what stocks to buy or sell and come without any explicit or implicit guarantee or warranty. The author focuses on mid-term and long-term prospects, not short-term gains, and may own shares in the company or the companies being analyzed.

Author: Sven Jösting, written March 20th, 2021

0 Comments