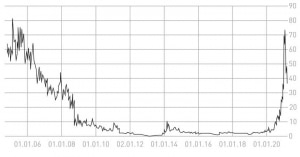

Plug Power [Nasdaq: PLUG] has undergone one financing round after another, with a third bought deal sandwiched in between, this time to the tune of more than USD 1.7 billion. What’s more, the South Korean SK Group has promised to put up USD 1.6 billion in return for a 9.9 percent ownership stake in the company, an investment that will also form a basis for a joint venture between the two corporations. And if that’s not enough, Plug, which is headquartered in the U.S., intends to fit out delivery vehicles for France’s Renault Group. Plus, the company has been busy buying in top talent for its management team. That’s the good news.

My concerns are raised, however, when I look at insider transactions: The CEO himself cashed in at prices of USD 60 to over USD 70, which allowed him to transfer a sum of more than USD 35 million to his private account. Other board members and management executives did the same, with a total value of all transactions equaling more than USD 100 million. It’s worth bearing in mind here that the business was worth around USD 700 million a year ago.

Now you could argue that the company has performed well, the coffers are brimming with a good USD 5 billion, the market value has exploded and the outlook could also not be better. That said, insider transactions should always give you some awareness of what the top brass think about the value of their own stock holdings. And we shouldn’t forget that Plug still remains dependent on two large corporations in particular, and they themselves have also accumulated paper gains worth billions through the receipt of warrants.

The pursuit of its own hydrogen production strategy is, however, indicative of the company’s goals. It’ll be exciting to see what happens with the liquid assets i.e., acquisitions. A stock market valuation in excess of USD 30 billion, including allowances for Amazon’s and Walmart’s warrants, is, in my opinion, optimistic – possibly too optimistic? – even if the market price of sub-USD 50 means that the USD 70-plus peak has been left far behind.

As a side note, Plug has been doing great in terms of public and investor relations and has already made many allies among its investment clients, at least that’s the impression you get from a quick delve into the forums. It would certainly seem that Plug is set to make strides in the fuel cell sector. In terms of valuation, I’m waiting to see what investment decisions are made further down the line as to how funds are used, and what the impact of that will be on revenue and the resulting margin.

Warrant value adjustment

I’ve written about this many times in the past: The two large customers Amazon and Walmart are in possession of warrants that they have received or will receive if a certain order volume has been or will be placed with Plug. In total we are talking over 110 million warrants which can be exercised at different prices – starting at USD 1.19 a share. Technically, Plug has only posted these in their accounts as non-cash charges: USD 456 million as an associated loss. Both corporations still have accounting profits in the region of more than USD 3 billion, which works out at more than USD 5 billion when Plug was listing at over USD 70 a share.

This chapter now seems to be at a close, of course bearing in mind that the number of underlying shares would equate to a considerable stock dilution should the warrants be exercised. On the other side of the coin, both customers are also good for new project business, since the two companies intend to invest massively in renewables, and hydrogen will surely have a role to play here – not just in forklifts.

Plug Power gets into hydrogen production

The most recent plans are highly ambitious and represent a step in precisely the right direction. Given the copious funds available, the company is in a good position to finance its own independent hydrogen production. In New York state, a production facility for green hydrogen is slated for the sum of USD 290 million which will be capable of turning out 45 metric tons of hydrogen a day. Start-up is anticipated in 2022. Further hydrogen production plants are also planned at a total of five locations spread across the U.S. and should be completed by 2024. This year, investments are planned totaling USD 750 million – a very positive indication in my view.

The conclusion: Plug will cut its own path in the hydrogen and fuel cell sector and will end up taking a leading position. The company is well positioned valuation-wise and is planning to turn over USD 1.4 billion in 2024, bringing it well into the black. I’m using the latest analyst opinions as a basis for my own: Barclays thinks the stock is overpriced, giving it a sell rating, and is aiming for an upside target of USD 29. In its view, the company’s value shows “a fundamental disconnect,” with much haze apparently surrounding the contracts for forklift conversion. On the other side, J.P. Morgan, whose analyst raised the upside target to USD 65, rated the stock as overweight. Here he reasons that Plug is a story stock, with the expectation that a new pedestal customer could come from Europe in 2021.

I have a vision that goes even further: Plug should take a stake in Nikola Motors and leverage the synergies since its business model, to my mind, has many similarities to Plug’s. It ranges from hydrogen production through to the new, strong growth market of hydrogen-powered commercial vehicles. The pair could form a very complementary partnership. But that’s just my take on it. For me personally, Plug is adequately valued but that is something that all investors must decide for themselves. And given the generally good trading environment for fuel cells and hydrogen, it stands to reason that Plug will naturally be swept along with the current.

Risk warning

Share trading can result in a total loss of your investment. Consider spreading the risk as a sensible precaution. The fuel cell companies mentioned in this article are small- and mid-cap businesses, which means their stocks may experience high volatility. The information in this article is based on publicly available sources, and the views and opinions expressed herein are those of the author only. They are not to be taken as a suggestion of what stocks to buy or sell and come without any explicit or implicit guarantee or warranty. The author focuses on mid-term and long-term prospects, not short-term gains, and may own shares in the company or the companies being analyzed.

Author: Sven Jösting, written March 20th, 2021

0 Comments