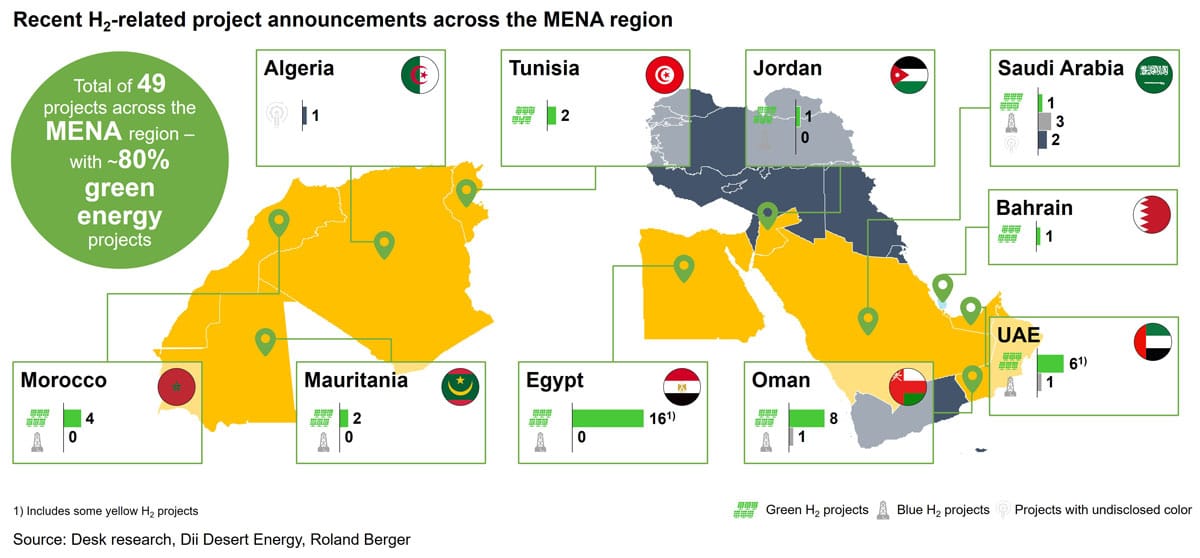

Our CTO Fadi Maalouf has developed models to calculate the costs of hydrogen, e-fuels and ammonia. Included are the announced H2 production costs for the projects planned for the coming years. Neom wants to produce hydrogen starting 2026 for about 1.5 USD per kilogram. That’s very ambitious. In Morocco, according to our model, costs under 2 USD per kilogram are possible. In Egypt, it could be a little more. Overall, however, we assume that there are many locations in the MENA region that will be able to generate hydrogen for 1.50 to 2.50 USD per kilogram by the middle of this decade, so the mid-2020s.

Then, however, the hydrogen is still in North Africa. By what means and at what cost does it come to Europe?

A transport by ship, including conversion, according to our estimate, would cost 1 to 2 USD per kilogram. With a pipeline, it would be significantly cheaper. If considering a new pipeline that would transport hydrogen from Egypt, Saudi Arabia and Jordan across the eastern Mediterranean, to be fed into the planned Hydrogen Backbone in Europe, the transport costs would lie at 50 US cents per kilogram, calculating over the entire lifetime of the pipeline, including capex and opex. With low production costs, as projected for Neom or even for later projects, it will therefore be possible to bring hydrogen all the way to Central Europe for 2 USD per kg.

The data on this comes from industry insiders in the oil and gas sector, like the King Abdullah Petroleum Studies and Research Center (KAPSARC) or ILF Beratende Ingenieure. ILF has already planned some pipelines in the region and can therefore make realistic assumptions on the costs. A possible specific route for the Africa-to-Europe line has also been quite well investigated.

Wouldn’t it be easier to repurpose existing pipelines or to blend the hydrogen into them?

There are parallel initiatives to repurpose existing lines and, for example, to bring hydrogen from Morocco to Spain. But just the current supply relationships alone are politically very complicated. Normally, gas from Algeria flows through Morocco and the Strait of Gibraltar to Spain. But Algeria has broken off diplomatic relations with Morocco and also stopped the supply of gas to it in November 2021, so Morocco was cut off from the direct means of supply. Now instead, Algerian gas comes first to Europe and then via Spain to Morocco. At the same time, Algeria is actually to be delivering more natural gas to Europe.

Also the blending of hydrogen in natural gas lines will presumably not play a large role. The natural gas would indeed be somewhat “greener” this way, but the real value of the flexible raw material that is hydrogen would be lost. That’s why this form of transport is not very attractive.

Nothing further needed there. So can we do without the billions in subsidies for the hydrogen economy?

It will not work without political support. Above all, a secure supply of green hydrogen needs to be ensured in Europe for the projects to be economically attractive – aided by clear regulation as well as internationally well-coordinated certification. The current Delegated Acts on hydrogen of the EU is rather an example of how to delay the necessary development. Countries like India act much more pragmatically here. Also the countries along the route need to be on board, particularly Greece, where the pipeline would come ashore, and Italy. Guarantees and private-public partnerships would be necessary. Many discussions are already underway, and I think the COP27 climate conference in November will bring further progress. Clear is that the major infrastructure changes must be on the political agenda – they won’t happen on their own.

This kind of thing can take time. How will hydrogen be coming to Europe in the next few years?

Pipelines, ammonia and e-fuels are all technologies for this decade. Besides pipelines, the most developed technology is definitely ammonia. There are over a hundred ships around the world that can carry it, many import and export terminals, and also a storage infrastructure. For the direct use in the chemical industry, for example at Covestro or BASF as well as the fertilizer industry, this is ideal. The technology reaches its limit when the ammonia is to be converted back into hydrogen. The cracking is energy intensive and not yet established on a large industrial scale.

LOHCs, that is Liquid Organic Hydrogen Carriers, also have a chance, but their success hinges on still many open questions. Liquid hydrogen, on the other hand, will not have a role in this decade. The technology is not yet mature enough for mass production. The test ship from Kawasaki has shown that intense development of many components is still necessary. But liquid hydrogen could have more significance in the 2030s.

Cornelius Matthes studied business administration and has been on the management team of the Desertec Industrial Initiative (Dii) since 2010 and CEO of Dii Desert Energy since January 2021. He started his professional career at the Deutsche Bank Group. As Managing Director MENA for the Italian project developer Building Energy from 2013 on, he established a new location for them in Dubai. Starting in 2016, he has also been founding his own project development and investment companies for renewable energies with various partners. Matthes advises renewable energy companies and investment funds, is a guest lecturer at various universities and was named Solar Pioneer 2015.

Interviewer: Eva Augsten

I am afraid, that the companies mentioned above,

will NOT be able to fulfill their promises,

given in their statements here.

The proof:

They all had their chances from the 1970s,

as all was known at that time already.

Even their second chance, around the year 2000,

when there was another hydrogen hype.

they have missed, to get something work-able done.

Working on a business model, which solely depends on governmental,

which means on taxpayer`s payments, will never be successfully on the long run.

Does anybody of you esteemed readers know one example of a Hydrogen project,

which was funded within the last 30 years and which went viral by now?

Give us just one example, please.