Short-term scarcity

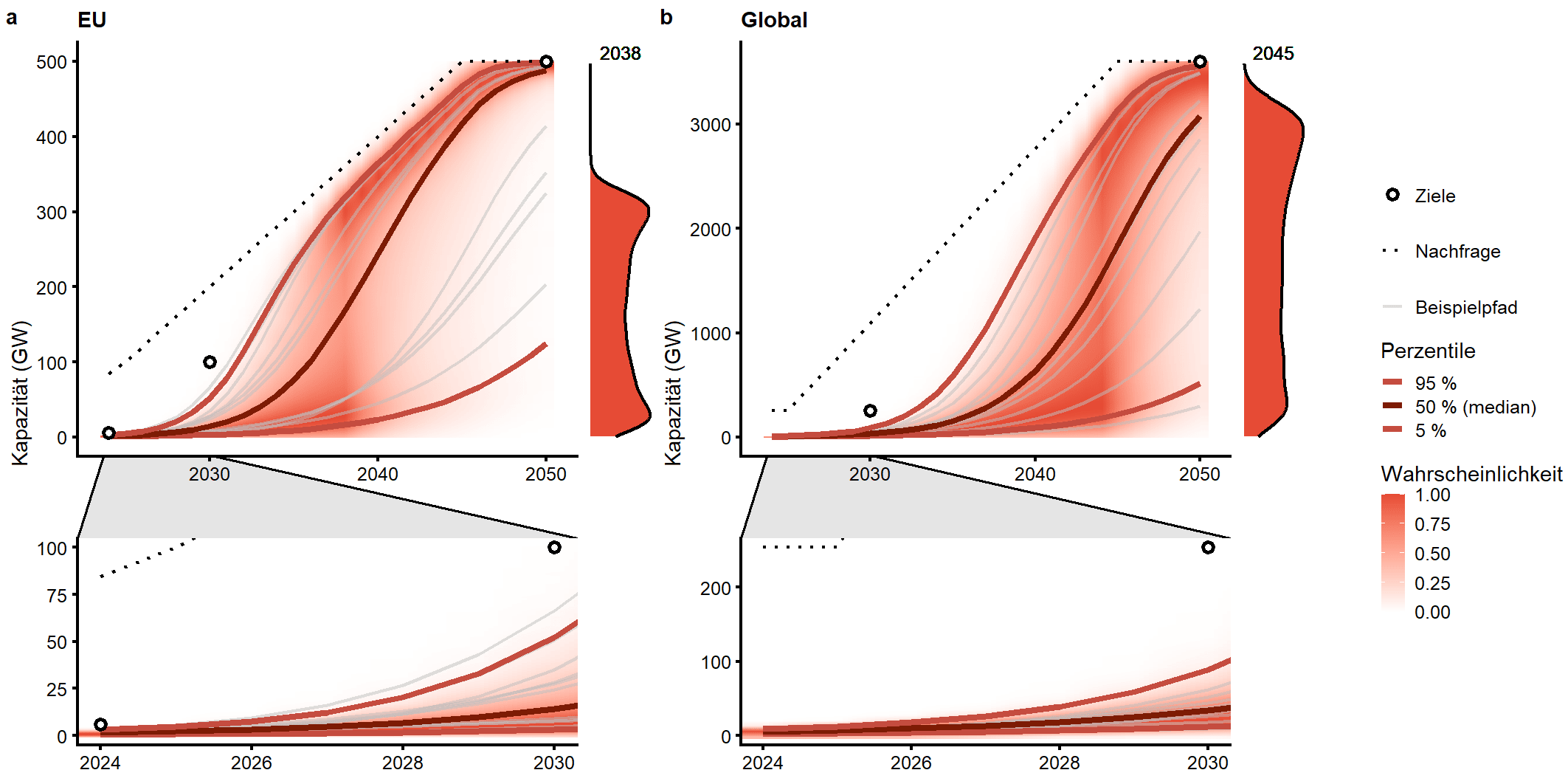

Even if similar growth rates are experienced to photovoltaics and wind energy, it still remains the case that electrolyzer capacity and therefore also the supply of green hydrogen will be insufficient for one or two decades. This applies both in comparison with the short-term and medium-term expansion targets and in comparison with the size of the overall energy system. In particular, the EU’s aim of producing 10 million metric tons a year of renewable hydrogen by 2030, which requires approximately 100 gigawatts of electrolyzer capacity, is not achievable with these growth rates. The same applies to the 720 gigawatts of global electrolyzer capacity that the IEA says are required by 2030 in its ambitious Net Zero Emissions scenario (IEA, 2022b).

In relation to the energy system as a whole this means that, even if electrolysis expands at the same speed as photovoltaics and wind energy, it will probably only be possible for green hydrogen to cover less than 1 percent of respective final energy demand in the EU by 2030 and worldwide by 2035.

Long-term uncertainty

The long-term view shows that a breakthrough to large-scale electrolyzer capacities is possible and becomes ever more likely. However, the timing and the size of this breakthrough are subject to considerable uncertainties.

In the event of similar growth rates to that of photovoltaics and wind energy, the breakthrough in the EU on average occurs by the year 2038 and globally by the year 2045. Given the great excitement surrounding the subject of hydrogen at the moment, that may be cause for surprise. Of course, when starting from a very small baseline, it takes a long time for high relative growth rates to also translate into high absolute capacities.

Growth under emergency measures

Our article describes an unbiased IF-THEN analysis based on the key assumption that electrolyzer capacity mirrors the speed of expansion in photovoltaics and wind energy. In the annex to the article, we presented a list of arguments for and against the issue of whether electrolysis could grow more rapidly than these successful technologies.

To investigate what might be possible under particular circumstances, we also asked the following question: “What would happen if electrolysis expands as quickly as technologies with the highest historical growth rates?” To answer this we looked at the growth rates of an extremely heterogeneous dataset, ranging from US military production and the expansion of the Chinese high-speed rail network to the market diffusion of web hosting and smartphones. The analysis shows that it is only by assuming these unusually high growth rates that the EU’s 2030 hydrogen target remains within reach and that the gap between possible supply and potential demand for hydrogen can be closed.

Political implications

It will only be possible to achieve these kinds of high growth rates with special political coordination, regulation and financing. Appropriate policy measures will need to safeguard the viability of private hydrogen investments, for example through public co-financing or direct regulation, e.g., via green hydrogen quotas. Furthermore, the ability to ramp up supply, demand and infrastructure simultaneously will require considerable coordination.

Thanks to the European Commission’s IPCEI hydrogen projects, the planned EU Hydrogen Bank and the US Inflation Reduction Act, the world’s two largest economies have recently given fresh impetus to the promotion of hydrogen. Nevertheless, it is still to be seen whether these measures are sufficient to break the vicious circle of uncertain supply, insufficient demand and incomplete infrastructure.

As long as the availability and the costs of green hydrogen remain uncertain, political decision-makers should be made aware of the risk of overestimating the potential of hydrogen. If future hydrogen supply exceeds expectations, it will not be problematical to find applications for it. By contrast if hydrogen supply lags behind expectations, however, it will then be too late for many applications to switch to alternatives in time to reach net-zero.

It continues to be a political balancing act: On the one hand, the speed of scale-up for green hydrogen needs to be increased considerably. On the other hand, the associated expectation of green hydrogen expansion should not slow down the necessary ramp-up in existing and more efficient alternatives of direct electrification, such as heat pumps and electric cars.

This study by the Potsdam Institute for Climate Impact Research was presented in February 2022 at the H2-Kompass conference in Berlin and was also reported upon in H2-international, May 2022. As the findings led to exaggerated headlines in the media in some instances, the key elements have been outlined again here in a little more detail.

Reference(s)

IEA. (2022a). Hydrogen Projects Database. https://www.iea.org/data-and-statistics/data-product/hydrogen-projects-database

IEA. (2022b). World Energy Outlook 2022. https://www.iea.org/reports/world-energy-outlook-2022

IRENA. (2020). Green hydrogen cost reduction: Scaling up electrolysers to meet the 1.5°C climate goal. International Renewable Energy Agency. https://www.irena.org/publications/2020/Dec/Green-hydrogen-cost-reduction

Odenweller, A., Ueckerdt, F., Nemet, G. F., Jensterle, M., & Luderer, G. (2022). Probabilistic feasibility space of scaling up green hydrogen supply. Nature Energy, 7(9), Art. 9. https://doi.org/10.1038/s41560-022-01097-4

Schulte, S., Sprenger, T., & Schlund, D. (2021). Perspektiven auf den Wasserstoffmarkthochlauf: Stakeholderanalyse mit Fokus Deutschland (EWI Policy Brief).

Authors:

Adrian Odenweller

adrian.odenweller@pik-potsdam.de

Dr. Falko Ueckerdt

falko.ueckerdt@pik-potsdam.de

Both from the Potsdam Institute for Climate Impact Research, Germany

Reading the recent (very detailed) Hydrogen Europe report ‘Clean Hydrogen Monitor 2022’ the issue of green hydrogen production within Europe by 2030 does seem to be mostly resolved. Under the REPowerEU strategy, 10m tons is planned to be built within Europe by 2030, and 10m tons is planned to be imported. The electrolyser manufacturing capacity is actually oversubscribed for 2030, so the question is whether there will be enough hydrogen produced outside Europe to make up the remaining 10m tons. About half this figure is so far in planning stages. So altogether, this is 15m tons, which is certainly impressive. In TWh terms, this is equivalent to 495TWh. Final energy consumption in the EU in 2021 was 11,258TWh, so this means we will see 4.4% of final energy being met by hydrogen by 2030. If the full target for 2030 is met (20m tons, or 660TWh) this will be 5.8% of final energy demand by 2030. This is really good news, and if energy ministers at the EU Council can agree to adopt what the Parliament and Commission have set out (the REPowerEU strategy), then there is a good chance of achieving this objective. The problem is with these ministers – more ambition is needed to fully achieve the 20m ton goal. I am optimistic, but I think it is important to recognise that it is individual member state energy ministers that need to be persuaded to see the value of fully adopting this goal.

Realistically, I believe it will be necessary to import blue hydrogen in addition to green hydrogen to fully replace fossil fuels. I don’t believe electrification will occur at the speed necessary to decarbonise; and more than this, establishing a global market for hydrogen is absolutely the next step in decarbonising globally, after gains so far made regarding solar and wind in decarbonising electricity.