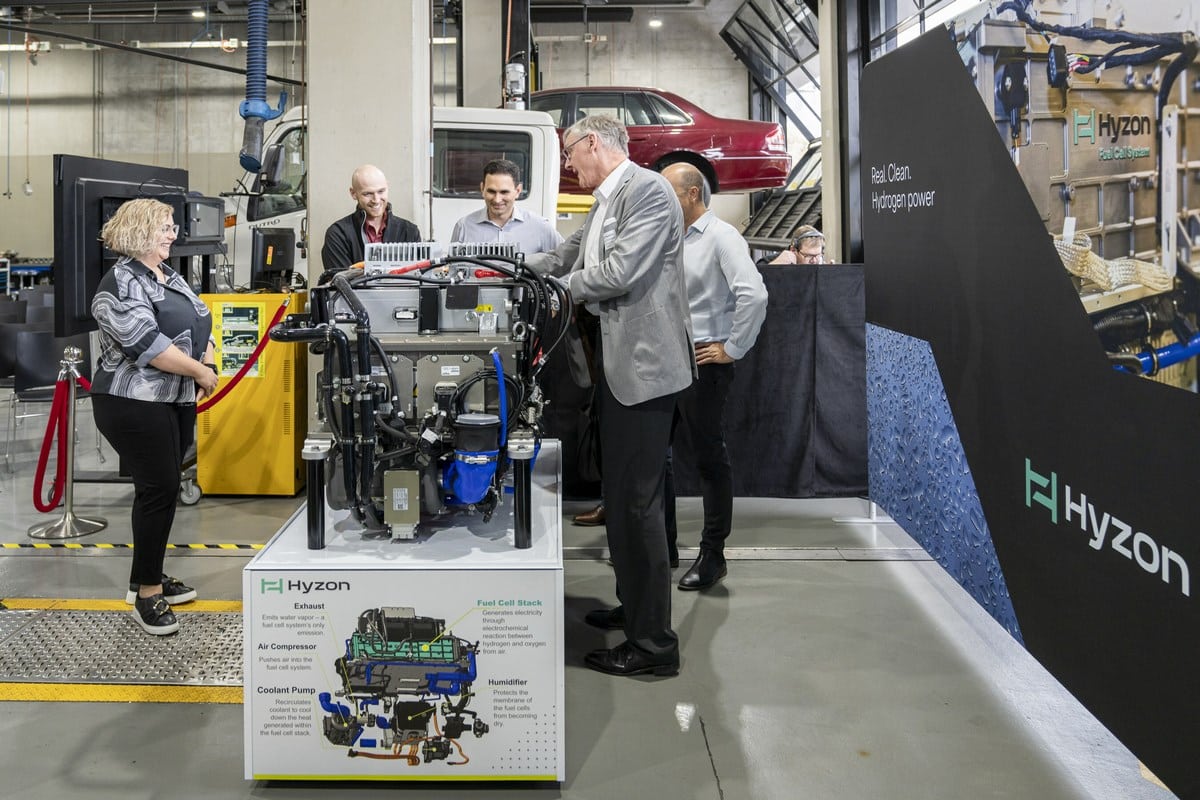

Ballard Power is positioning itself as a leading player in the use of fuel cells in the transportation sector. The Canadian company wants to occupy a top position in the new megatrend and expand it to benefit from the tremendous growth expected in the coming years (orders and scaling = revenue and profit). As outlined at the last press conference on the accounting for the third quarter, Ballard is developing a global manufacturing strategy that has the goal of approaching cost reduction potentials and scaling effects as well as supply chain topics on site and using this to their advantage. This is referred to as a local-for-local strategy. It means that Ballard is erecting its own production facility within each country or continent so that it can benefit from the local conditions by being locally present. The sourcing of supply parts, but also the research and development as well as supply chain, will be established there. A perfect example is China.

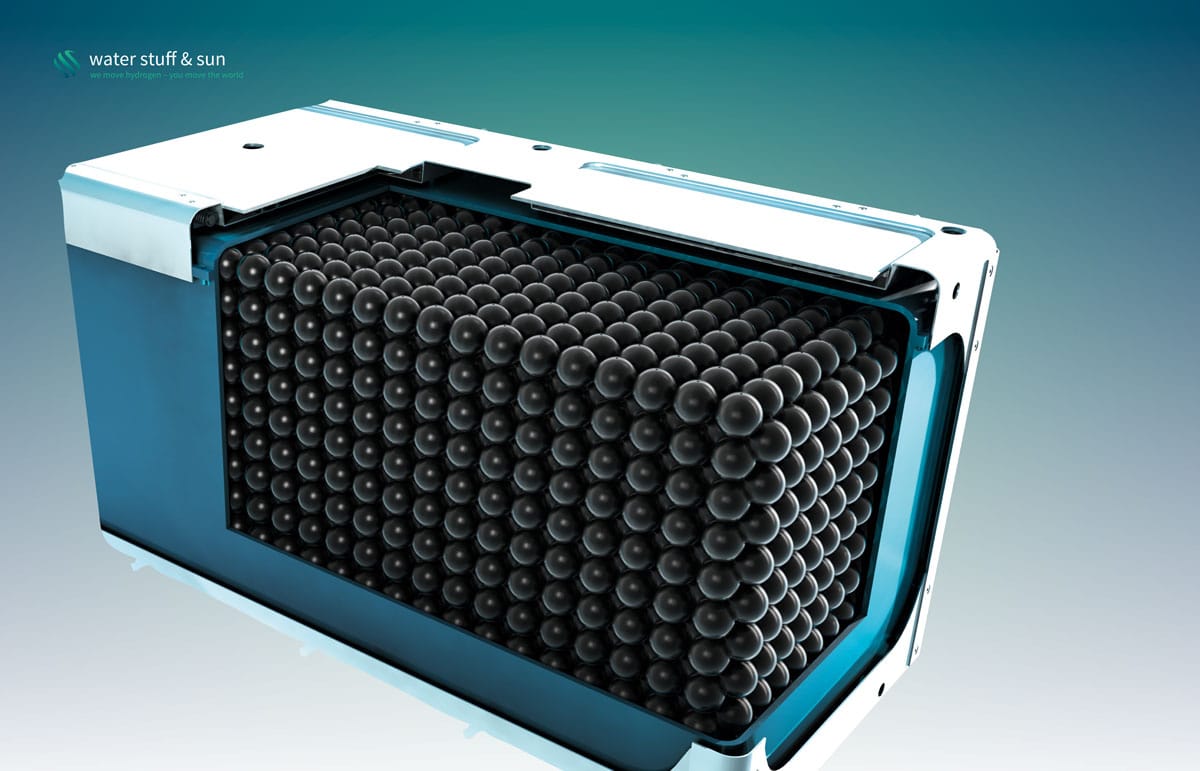

Ballard is maintaining a joint venture with Weichai (49:51), which today already has an FC stack production capacity for 20,000 vehicles (buses, forklifts, trucks) that can very quickly be ramped up and expanded as needed, which is thoroughly the aim. Ballard is now planning, with an invest in the amount of 130 million USD over a period of three years, to establish its own MEA production as well as its own research center in China. The site was chosen to be Jiading Hydrogen Port, located in the Greater Shanghai metropolitan area, as this region has one of the largest clusters of automotive supply companies in China. The MEA production here should provide for 20,000 vehicles.

The membrane electrode assembly (MEA) is the core of the fuel cell and accounts for a considerable 60 percent of its cost. With this production facility, Ballard will become one of the largest MEA producers in the giant land. In addition to the support programs, however, China has set conditions for manufacturing in the country. In order to a) participate in these subsidy programs and b) not be subjected to increasing tariffs, parts like MEAs should be imported from China. We’re talking about tariff rates starting at three to five percent and rising to fifteen percent within three years. This would have a massive negative impact on the future profit margin. Ballard president Randy McEwen said on the matter, “Imported MEAs have a competitive disadvantage.”

Support programs are at the starting blocks in China

Until now, it was only individual provinces and large cities like Guangdong und Shanghai that recognized hydrogen and fuel cell technology as a growth market for themselves. But the government of China, as proclaimed during the 20th Communist Party Congress with the associated funding programs, however partially defined, is increasing committing to this field. Very large programs are expected. So far, Ballard’s China business is turning out smaller than hoped for, which was set back by among other things COVID-related restrictions, which contributed to a considerable 68 percent decline in activities there. However, this is only a slice in time – the potential could not be greater, as China will in great likelihood approach hydrogen and fuel cells in the same way it has done solar cells and wind power.

Great interest in rail vehicles

In the transportation sector, Ballard is optimally positioned. From Siemens Mobility already stands an order for 100 FC modules, and also a letter of intent for another 100. In Europe alone, 13,000 locomotives will be converted from diesel to hydrogen or battery-electric within the next 15 years, with 3,000 of these for Germany. This spirit could further spread to the USA and many other countries. In addition to the first H2 train in India, Ballard has been active in the US. It can be assumed as very probable that after the pilot projects, large orders will arise from there.

For the Canadian Pacific Railway (CP), the FC manufacturer is already in the process of converting four different types of locomotives from diesel to hydrogen power. CP has over 1,400 locomotives in use, so with this customer alone is the potential for many rail vehicles. CP represents the possibility of many other railroad companies, for example Amtrak. FC use in trains is seeing a breakthrough, but for now we’re only looking at the start.

Ballard is the first provider of its kind for rail vehicles in the USA. The company Stadler Rail from Switzerland is putting a train on the tracks there equipped with FC systems from Ballard. There are also whispers that Amtrak California has plans for another 27 trains, which would likely mean an order for Stadler and, indirectly, for Ballard. The order from Siemens Mobility (14 modules for 7 Mireo Plus H trains) as well as the declaration of intent for up to 200 further modules – 100 of these fixed – we already reported.

Here, huge markets are arising. In the USA alone, only one percent of all railroads are electrified. The vast remaining trains can be outfitted with batteries (short-range) and fuel cells (long-range) as well as combination models (FC as range extender). In addition, Ballard is associated with the world’s largest rail vehicle corporation, CRRC in China, which has already tested streetcars with Ballard inside (first with blue hydrogen, to be replaced by green as soon as sufficiently available).

Investment in Quantron

Together with Neuman & Esser, Ballard has built an H2 alliance with the German commercial vehicle manufacturer Quantron. This concerns trucks and buses. Both partners participated in the initial invest of 50 million EUR. At the 2022 IAA Transportation event, Quantron presented its truck with type designation QHM (see p. 32), which gets its power from Ballard fuel cells. Eventually, these vehicles could have a range of up to 1,500 km (930 mi) – at least in Norway – with 120 kg of H2. Hydrogen on board and Ballard inside. Quantron recently announced an initial order for 500 trucks from the USA. There, competitors like MAN (which may also commit to fuel cells starting 2030) and Daimler Truck have let (too much) time go.

The partnership Ballard–Quantron–NEA addresses the issue of infrastructure as well. It is to develop hydrogen fueling stations as well as H2 production capabilities, to be able to offer customers a complete package. Such cooperations – like already existing, very successful ones with various bus manufacturers –Ballard will be able to mobilize in the coming years to ramp up production capacities for its FC modules and be at the forefront of this new world market in terms of timing. The stock market also cannot avoid valuating this potential.

Third-quarter figures don’t say much

The company figures (turnover, results) will for the foreseeable future not have relevance for Ballard that analysts can see, as the company is positioning itself step by step in different regions of the world to benefit from very high long-term growth as a market leader. In the third quarter, the company had a turnover of 21.3 million USD, which corresponds to a year-on-year decrease of 15 percent. Indicative power: zero. Loss per share: minus 0.14 USD. Cash and cash equivalents lay at 957.4 million USD on September 30, 2022. The stock market value therefore amounts to only 1.6 billion USD. The order volume, however, rose by over 30 million USD, to a worth of 101.7 million USD during this quarter.

Last but not least: 25 FC modules ordered by Solaris

According to the latest news, the Polish bus operator Solaris has given Ballard an order for another 25 FC modules to be used in Poland. Such orders we will now see frequently and with an increasing number of modules requested, since many cities, in Europe especially, feel obligated to stem climate change and reduce their carbon footprints with the help of such emissions-free buses. We would not be surprised if cities like Hamburg were also to place larger orders for FC modules or FC buses.

Summary

The share price in the next 12 to 18 months will not be driven by quarterly results, but by news from the individual partnerships – so-called platform partnerships – and by strategically important news. Some of the orders (FC stacks/modules) for rail vehicles, trucks, buses and ships may also greatly shape the development of the price, but the effects of the really big orders, contingent on the ongoing scaling measures in the form of establishing production sites, will not take hold until sometime in 2023 and then properly from 2024/25 onwards. In anticipation, the stock market will be inclined to allow these prospects to flow into the share price development, even if the high investments and capital outflows (invest in production in the USA, in Europe and in China as well as stakes in for example Forsee Power) cause logical losses. Keep in mind that H2 and FC technology is a new megatrend, which will slowly and then more and more pick up speed and create completely new markets. Whoever lies ahead technologically (for example with competitive products) will be rewarded by the stock market with a good share price performance. Fantastic progressions could always arise as well, in the event that a major corporation like the Adani Group knows how to leverage the currently very low share prices for a stake. All you need is time for the invest to pay off, according to our analysis of all the circumstances. The current prices are clearly buy prices.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: written by Sven Jösting December 12th, 2022

0 Comments

Trackbacks/Pingbacks