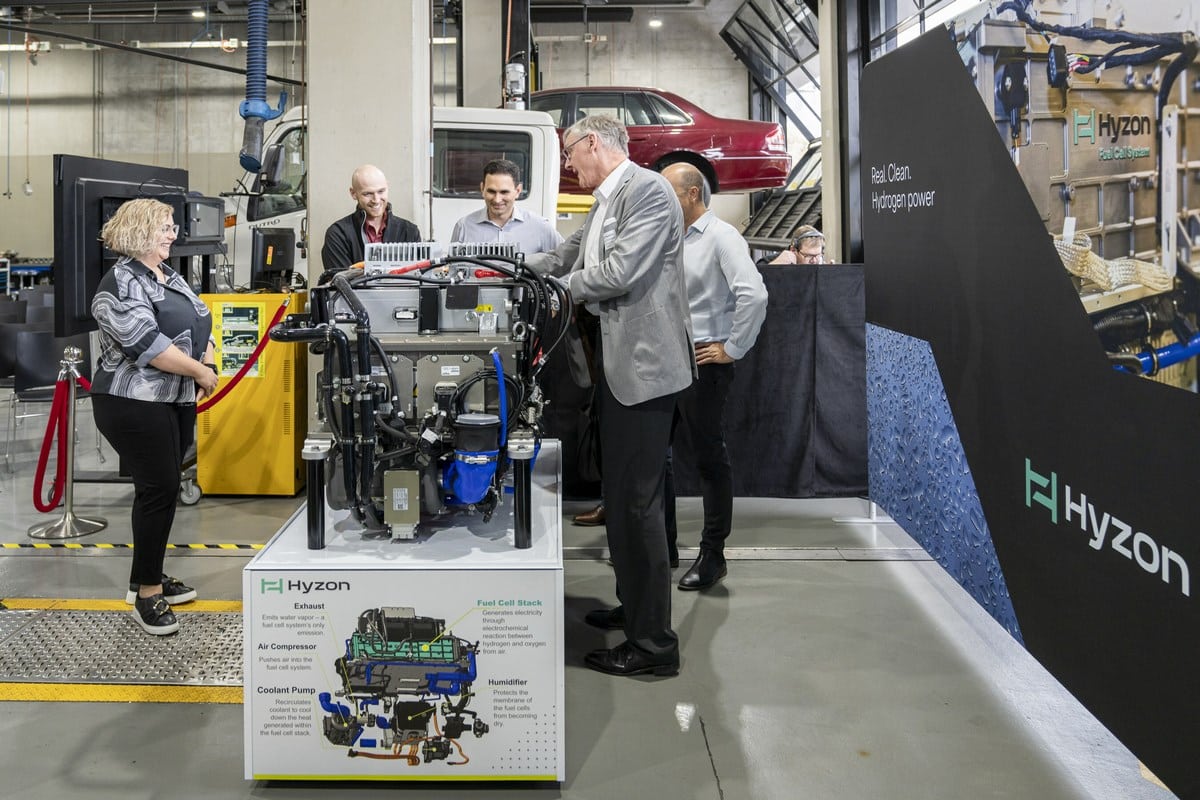

After the second-quarter figures from Ballard Power Systems came in at the end of June, there were several good news that underline which huge potential the Canadian fuel cell manufacturer can tap in China and Japan. The share price jumped more than 60 percent. The most recent business Ballard won over as a partner was Chinese Broad-Ocean. The corporation boasts an annual production of more than 50 million motors worldwide and supplies several top-notch carmakers (Caterpillar, Tata, etc.), leading bus companies such as King Long and Van Hool among them. It has already bought a 9.9% stake in Ballard for USD 28.3 million and may increase its stake in the company to 20% – without receiving any position on the manufacturer’s executive or supervisory board. Still, the Chinese organization could become a very important customer – even if only indirectly through a special agreement.

Broad-Ocean placed an order for bus stacks with Ballard after the latter had finalized its meticulously negotiated agreement with Guangdong Nation Synergy Hydrogen Power Technology (Synergy). As part of a joint-venture (90 : 10), Synergy has been collaborating with Ballard to develop production capacities for fuel cell bus stacks in China. The overall investment in the project is said to be USD 450 million, which the Chinese corporation intends to pay for. During a recent phone conference, it was said that the start of production was scheduled for 2017. The initial target is 6,000 stacks in the first, 10,000 in the second and 20,000 each year thereafter.

Broad-Ocean

Zhongshan Broad-Ocean Motor operates around the globe, but primarily in five Chinese cities which house the production facilities of leading bus manufacturers. Since Broad-Ocean has already placed an order for 10,000 fuel cell cars with Synergy, I suspect it will supply fuel cell stacks to several Chinese bus manufacturers or integrate these stacks with their buses. It seems reasonable to assume that this is the reason for the large order volume. Ballard could use the collaboration with Broad-Ocean as a perfect opportunity to manage sales of fuel cell stacks produced in collaboration with Synergy – what a strategic move. By the way, Synergy was the one from which Ballard received its first large order of 300 fuel cell stacks.

While Ballard will supply the important MEA components (membrane electrode assembly; 60% of the value content of a stack) and retains the exclusive rights to globally distribute the fuel cell stacks, Synergy will turn its focus on China. A great coup with which Ballard can make the most of the economies of scale offered by the Chinese mass production of fuel cells. An interesting side note is that Ballard will be able to exert much control and influence over the collaboration. Revenue from it is expected to add up to USD 168 million or more over five years – that is, revenue generated by Ballard alone for providing stacks, technical support and employee training.

Stacks for radio masts

Ballard also sold hydrogen-powered fuel cell stacks for radio masts to Synergy, which has provided the company with just the right product to serve the Chinese market. A potential contact for Synergy is the China Tower corporation: It manages the infrastructure activities of telecommunications companies China Telecom, China Mobile and Unicom, with assets valued at USD 36 billion. All in all, Ballard can continue to profit from license revenue without having to invest any of its own money. And a Chinese corporation like Synergy – or Broad-Ocean – will certainly be able to negotiate better terms when dealing with domestic businesses than a foreign enterprise ever could.

Toyota Tsusho as new partner

The next piece of good news came from Japan: Toyota Tsusho, a subsidiary of Toyota with USD 76 billion in annual revenue, aims to sell Ballard’s products in Japan. A press release even said that in joining forces with Ballard, it intended to make an important contribution to Japan becoming a “hydrogen society.” The framework agreement, the terms of which can only be speculated about, will be in effect at least until 2020.

The remarkable thing about all of this is that Toyota, the pioneer in fuel cells, is collaborating with Ballard, which shows just how much Ballard is held in high esteem. The press release explicitly stated that Ballard was the leader in fuel cell manufacturing. The deal could mean so many things. I wager that Ballard products, such as the ones manufactured jointly with Synergy and Broad-Ocean in China (fuel stacks for buses and other vehicles, as well as for forklift trucks, for which Toyota holds the top spot globally), could be sold through Toyota on several Japanese markets. And Ballard has received the exclusive rights to market several of the stacks produced by Synergy, which means the rights to distribute the products outside of China. There is a lot of room for interpretation – but whatever the conclusion, the outcome will be favorable to Ballard.

Hydrogenics as a candidate for takeover?

Additionally, Ballard’s cost-cutting program seems to be showing its full impact. The sale of backup power systems (H2 fuel cells in China and methanol fuel cells in South Korea) for radio masts of two business partners will be enough to prompt an upward trend in the share price over the coming quarters. Not only was the Canadian-based company able to divest costly and low-margin business activities, but it can now earn money through licensing and supply without having to make any investment. Second-quarter revenue rose considerably (+58%) and the gross profit margin made a big jump (+29%).

Broad-Ocean’s purchase of 17.25 million shares means Ballard has more than USD 70 million in his well-filled war chest. It’s conceivable that these and new shares sold in the future could allow the company to make strategically intriguing acquisitions. Candidates for takeover need to generate at least USD 15 million revenue and a gross profit margin of above 30% (we will see). Acquisitions could still be made this year; two out of four takeover targets are said to be left. If I were on the board of Ballard, I would consider acquiring Hydrogenics to add fields such as H2 infrastructure/filling stations and electrolysis systems to the business portfolio. Fuel cell buses in China need H2 filling stations like in any other country and as a Ballard subsidiary, Hydrogenics could benefit from the parent company’s collaboration with Synergy and Broad-Ocean, but also Toyota (in theory). Hydrogenics (in collaboration with Alstom) has also been involved in the design of hydrogen-run trains – another addition to Ballard’s product offering. And both organizations are headquartered in Canada.

Outlook

In a September press release, Ballard touted the strong relationship it had been developing with CRRC. The Chinese railroad car manufacturer had already been supplied with fuel cell prototypes for their hydrogen-run trains and streetcars, and had fuel cell systems integrated into their vehicles. Orders will only be a matter of time. The partnerships with Broad-Ocean and Synergy in China, the one with Toyota in Japan and several projects with VW and others are likely to prompt a re-evaluation of Ballard shares and drive up the stock price. Another piece of good news was announced by Ballard subsidiary Protonex: US authorities have recently granted the business essential import and export permits for drones used by civilians. They will make up the next vast global market for fuel cells – just think about the plans by logistics companies like Amazon.

The more people become aware of the new megatrend fuel cells and H2, the more will Ballard be viewed as the industry’s number one and the stock price will go up accordingly. I except it to get to double digits over the next three years. It will also be interesting to see what happens when Ballard can report the first quarterly profit in its history – it’s on the best way to do just that. And whoever wants to bet on fuel cells on the stock market: There won’t be a way around Ballard as the leader of the pack.

Risk warning

Investors must understand that buying and selling shares is done at their own risk. Consider spreading the risk as a sensible precaution. The fuel cell companies mentioned in this article are small and mid-cap ones, i.e., they do not represent stakes in big companies and the volatility is significantly higher. This article is not to be taken as a recommendation of what shares to buy or sell – it comes without any explicit or implicit guarantee or warranty. All information is based on publicly available sources and the assessments put forth in this article represent exclusively the author’s own opinion. This article focuses on mid-term and long-term perspectives and not short-term profit. The author may own shares in any of the companies mentioned in this article.

Author: Sven Jösting

0 Comments