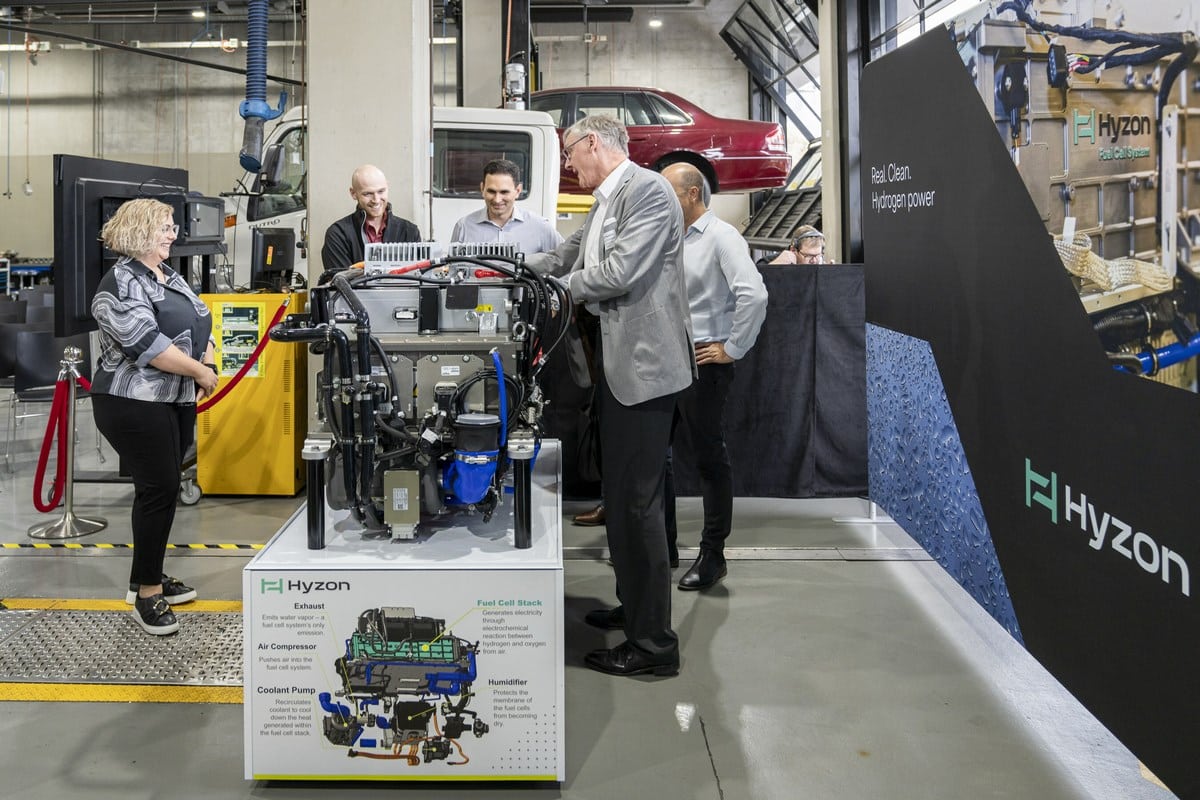

At the stock exchange, you may get the feeling that all companies dealing in fuel cells and hydrogen technologically and as a business model are one group moving in parallel, as expressed in the trend of their stock prices. However, this is far too undifferentiating, because the companies rely on completely different business strategies. One builds filling stations for hydrogen and produces electrolyzers (e.g. Nel, ITM, Plug Power, Bloom), while another produces fuel cell stacks and modules (e.g. Ballard Power, PowerCell, Cummins, Weichai Power).

Some providers focus on specific applications, others offer multiple solutions so as to be a one-stop shopping partner like, for example, an OEM that sells complete FC powertrains for various fields of use. Then, there are the providers of solutions designed to produce electricity and heat via fuel cells or to produce hydrogen on site (e.g. Bloom Energy, Enapter, FuelCell Energy). Or to trade hydrogen as a commodity (e.g. Plug Power, Bloom Energy).

Then, there are the large industrial groups that are either active in the large-scale production of hydrogen across the color spectrum (e.g. Linde, Air Liquide, Air Products) or see themselves as plant manufacturers. A business model might involve total solutions for the manufacture and distribution of clean energy, from the (electrolysis) stations for producing hydrogen to the FC power plants to generate electricity and heat, where the networking of regenerative energy sources with hydrogen takes place (also via CHP) and is conducted by a single provider (e.g. Siemens Energy).

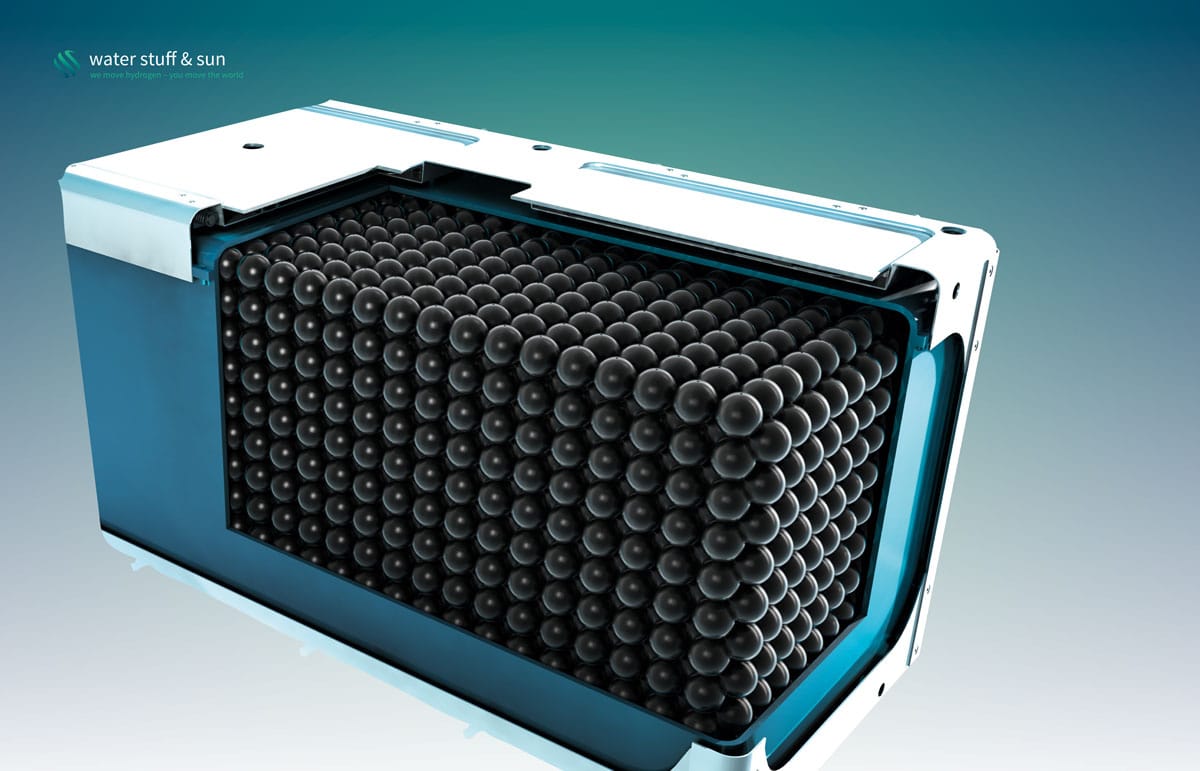

In addition, there are new business models based on development of unique, perhaps proprietary technology, software or hardware to capitalize on hydrogen as a consumable, similar to ink in toner cartridges for printers (e.g. Bloom Energy, Plug Power, Nikola Motors).[…]

… Read this article to the end in the latest H2-International

Warning

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: Sven Jösting, written March 15th, 2022

0 Comments