A full decarbonization of the European energy supply to achieve the 1.5 °C target from the Paris agreement is not a question of “if” but of “how”. In particular, the European Green Deal envisages climate neutrality by 2050 based on renewable energy sources (RES) as top priority of its political agenda for the coming decades [1]. What is more, the International Energy Agency (IEA) promotes a radical paradigm change of the global energy supply in favour of RES [2]. In Germany, a foregoing climate policy has been fortified by the federal German Constitutional Court’s groundbreaking verdict to introduce more stringent climate policies as a reaction to several constitutional complaints against failing climate policy. In the Netherlands, the local Den Haag Court of Justice has ruled that Shell shall amplify its CO2-emission reduction measures in its global operations [3] [4] [5].

Both the European Commission and the IEA underpin that hydrogen should gain a key role in the power sector as well as in all other energy sectors on the way towards zero CO2 emissions [1] [2]. Hydrogen can be easily stored in large quantities for long periods of time and used for re-electrification in corresponding power plants. In this way, it can contribute to integrate intermittent renewable power into the energy system [2].

In this context, an important question referring to the optimal mix for hydrogen production has yet not been answered: from which energy sources and in which world regions shall (green) hydrogen be produced and what are relevant corresponding international strategies? From the German and European perspective, multiple hydrogen supply options could be chosen from as hydrogen is a universal energy carrier which can be produced by different and in the future more decentralised technologies around the globe [6] [7].

Multiple hydrogen production options

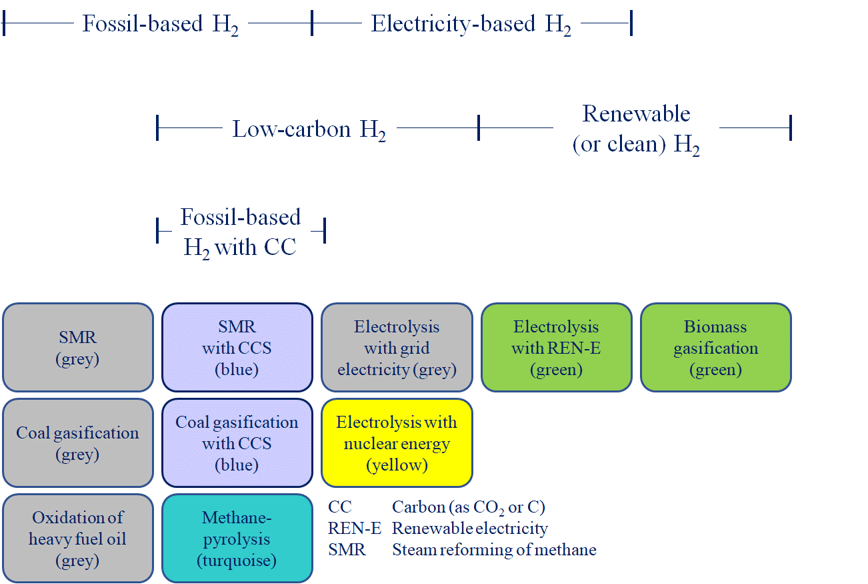

Following the official terminology of the European Commission concerning different production pathways [8], hydrogen is classified as “fossil-based H2” and “electricity-based H2”, distinguished by primary energy input (e.g. natural gas, mineral oil or electricity) and the respective key production technology. These two classes are subdivided into “low-carbon H2” (incl. “fossil-based H2” with carbon capture as well as “H2 from electrolysis with electricity from grid or nuclear electricity”) on the one side and “renewable or clean H2” through electrolysis with renewable electricity (REN-E) on the other side. In addition, the following terms are being used:

- Green hydrogen (electrolysis based on renewable electricity or gasification of biomass),

- Blue hydrogen (traditional process from fossil energy with carbon capture and storage – CCS),

- Turquoise hydrogen (methane pyrolysis),

- Yellow or red hydrogen (electrolysis based on nuclear electricity) and

- Grey hydrogen (traditional processes without CCS or electrolysis based on grid electricity).

The structure of terms and the colour coding are depicted in Figure 1.

Traditional production technologies

The traditional hydrogen production technologies belong to the group of fossil-based processes, today typically dominating global bulk hydrogen production. Steam reforming of natural gas or methane (SMR) is the principal process technology (catalytic, endothermal) in (chemical) industry which requires steam as single additional feedstock and with highest efficiencies in large plants. Worldwide, about 2% of global coal and 6% of global natural gas consumption is used for hydrogen production, out of which 73 MtH2/a are converted to pure hydrogen and a further 42 MtH2/a blended with synthesis gases [6].

Another similar and widely applied industry process technology is dubbed partial oxidation of heavy fuel oil (POX), which requires oxygen as feedstock (non-catalytic for sulphur-containing fuels, exothermal). It is applied in locations where cheap heavy fuel oil (HFO) is available such as in oil refineries. By combining both processes through adjusting a stochiometric equilibrium of steam and oxygen feeds, the highly dynamic autothermal reformation process (ATR) has been developed for e.g. natural gas as feed at a somewhat reduced overall efficiency (65% instead of the up to 80% of SMR). Another advantage of this technology is that the resulting synthesis gas has high hydrogen contents.

Furthermore, the reaction is energy neutral, i.e. neither auxiliary thermal energy is required nor waste- or off-heat need to be considered, allowing a robust process design (Table 1). With the goal to substitute fossil by renewable energy according to emission reduction targets, SMR, POX and ATR will only contribute temporarily. Both regional and logistic aspects have to be considered in assessing an economic competitiveness of fossil hydrogen over time, and the degree to which CO2 can be taken out of the atmosphere at the given and measurable scale.

All fossil processes are characterised by highest efficiencies at large plant scales even though there is a small market for decentral yet less efficient methane steam reformers today. Nevertheless, the current hydrogen supply is dominated by the delivery (merchant hydrogen) or production of large hydrogen quantities onsite.

Tab. 1: Key data of the most relevant hydrogen production technologies

|

H2-class |

Technology |

TRL1 |

Costs |

Efficiency |

CO2-emissions |

Operating |

|

Fossil-based H2 |

SMR |

9 |

1.5 – 63 |

65 – 803 |

310 – 4003 |

700 – 800 |

|

POX |

9 |

1.5 |

69 |

1,300 |

||

|

ATR |

9 |

1.5 |

65 |

850 – 1,300 |

||

|

Pyrolysis4 |

3 – 7 |

2.5 – 7 |

30 – 60 |

190 – 230 |

600 – 1,600 |

|

|

Renewable |

Gasification |

7 |

3 – 5.53 |

45 – 703 |

40 – 903,5 |

T-Bandwidth6 |

|

PEMEL |

8 – 9 |

3 – 6.57 |

59 … 71 |

08 |

50 – 100 |

|

|

AEL |

9 |

3 – 6.57 |

58 … 67 |

08 |

70 – 90 |

|

|

SOEL |

5 -7 |

>80 |

08 |

700 – 900 |

1 TRL – Technology Readiness Level; 2 LHV – Lower heating value; 3 Depending on plant scale; 4 Bandwidth depending on technology; 5 For larger plants also depending on transport distances for biomass; 6 The reaction zone comprises a temperature bandwidth [10]; 7 Strongly dependent on electricity supply costs; 8 Only for full renewable electricity utilization

Pyrolysis, electrolysis and biomass-gasification

Another fossil energy based hydrogen production technology – undergoing commercialization since only recently – is the so called methane pyrolysis. It comprises a class of process technologies of its own, all having a high specific energy input in common. Possible concepts are the electric arc or microwave plasma processes (using direct electricity as energy input) or the energy contained in part of the methane feed to heat a (catalytic) moving reaction bed reactor at very high temperatures crushing the remaining methane share into its constituents hydrogen and carbon. On the one hand, an advantage of all pyrolysis based processes is solid carbon as final product instead of gaseous – and hence difficult to handle – CO2. If applied well, solid carbon can be re-utilized in a way that no CO2 is released to the atmosphere in any of the consecutive processes. On the other hand, the pyrolysis process is highly dynamic and difficult to control, i.e. it is not as robust as SMR. Finally, also the solid carbon markets are rather limited seen from an energy market scale perspective.

The key technology for green hydrogen production is electrolysis. It comprises a group of technologies, splitting water into its constituents hydrogen and oxygen using electricity as energy input. The proton exchange or membrane technology (PEMEL) applies solid proton conducting membranes whereas alkaline electrolysers (AEL) use caustic soda in an internal electrolyte circulation loop and as gas carrier. Both technologies are operated at low temperature in opposite to the high temperature or solid oxide electrolysis (SOEL) using a steam feed at up to 850°C. SOEL apply solid anode and cathode layers, plated on a gastight ceramic carrier substrate. The Anion-Exchange-Membrane Electrolysis (AEMEL) has begun to be offered in the market only recently and currently in small numbers. It promises however to be comparatively cost efficient as the use of Pt-group catalysts is avoided and at the same operational dynamics as PEM electrolysis.

Another relevant green hydrogen production pathway is the gasification of biomass or biogenic residues applying steam in an allothermic process (Güssing principle) [10]. As compared to low temperature AEL and PEMEL this technology has not been widely commercialized yet. Furthermore, its wide application is hampered by the limitation of available biomasses or (non-)organic residues in Europe.

Beyond hydrogen from electrolysis, it may also be produced through further green hydrogen production pathways (see Fig. 2). A thorough assessment of 10 process technologies found, however, that most of the alternative options are limited by either region specific advantages or are at a very early research or development stage

Other term widely used today is “by-product H2” The term is applied to (chemical) processes (e.g.in refineries) in which hydrogen is produced “inadvertently” and can be made readily available at low cost in large quantities. As today’s by-product hydrogen is generated through fossil based processes it is in principle also denoted as grey hydrogen, i.e. characterized by similar specific CO2 emission levels.

Depending either on production technology or customer specific quality requirements, the hydrogen delivered has to be purified by a set of gas cleaners designed to meet the relevant end-user needs by impurities, process layout and plant scale. Typically and according to recent agreements by European gas industry, this will comprise industry grade hydrogen in dedicated hydrogen transmission grids or fuel cell grade hydrogen with a very low level of hydrogen impurities

Natural hydrogen has been dubbed as “white” and is not industrially applied today. As its exploitable potentials are limited in view of the energy markets, white hydrogen from indigenous sources such as from Africa or Brazil is believed to have little impact on the development of future hydrogen energy markets, even though further analysis is being undertaken [11] [12] [13].

Power-to-X as major ingredient for renewable hydrogen production

Water electrolysis is the key process technology of all Power-to-X concepts which are the basis of green hydrogen supply. Power-to-X can be principally subdivided in different main pathway routes. The major concept is the one of Power-to-Gas (PtG) with its two options Power-to-Hydrogen (PtH2) and Power-to-Methane (PtCH4). Further Power-to-X concepts, extending the gas-focused energy world by other alternatives are: e.g. Power-to-Heat (PtH), Power-to-Liquids (PtL) as well as Power-to-Chemicals (PtCh). With the exemption of PtH, all concepts are unified by the common and central hydrogen molecule [14].

A major consequence is that electrolysis is seen as key technology for the future sustainable energy supply, with high electrical efficiency at all scales, large and small. This is the consequence of electrolysis being a surface-driven process for which only the balance-of-plant equipment’s efficiency does not scale linearly, and in contrast to volume-driven processes which are characterised by significantly increasing efficiencies towards larger process scales. The underlying argument is that today’s fossil or nuclear primary energies will be substituted by electrons as major primary energy source. Electrolytic hydrogen can thus contribute to seasonal energy storage at large scale and supplement the short-period local energy storage of electrons in mechanic-kinetic (e.g. flywheel) or mechanic-potential (pumped hydro storage) or electrochemical storage (e.g. batteries) systems. A side-effect is the substitution of a large number of aboveground electricity transmission lines with large specific footprint by cost efficient and publicly acceptable underground gas pipelines with a low specific footprint.

The CAPEX-dominated costs and resource-intense application of large-scale electricity transport and storage will thus be pushed towards OPEX-dominated costs, combined with the high energy-density gas transport/storage. With a view to water intensity, electrolysis consumes about 9 kg of water per kg of hydrogen, a factor asking for monitoring in the future. This poses no substantial challenge for central Europe (e.g. a long-term production of 100-400 TWhH2/a of hydrogen for the case of Germany would require the provision of ca. 27-108 Mt/a of water, equivalent to about 0.7-3.0% of all German drinking water needs today). In addition, it should be born in mind that water after thermal use in fuel cells becomes part of a natural water recirculation, even though locally uncoupled in case of large scale hydrogen imports.

International hydrogen production strategies

Several strategic considerations accompany the techno-economic aspects of introducing hydrogen into the energy system at large scale. In general, they strongly depend on regional framework conditions in different countries and specifically the individual strategic energy and industry policy targets, climate policy ambitions or availability of natural energy or material resources as well as societal development ambitions. Typically, these aspects are reflected in the national hydrogen strategies, being developed by different countries worldwide [15].

In view of the international context, the strategies to introduce hydrogen as energy carrier foresee two phases (Fig. 3). The first phase until 2030 typically comprises an activation of potential H2 markets. Being a transitional phase, all hydrogen colours will typically be allowed by policy makers for cost and capacity arguments. Just a few countries with specifically large renewable energy potentials such as Spain, Portugal, Ukraine, Chile or Morocco put their focus explicitly only on green hydrogen from the very beginning. In contrast, in e.g. Japan and South Korea also grey hydrogen will contribute to the H2 production mix due to cost reduction considerations (Japan) or yet less ambitious climate policy goals (e.g. South Korea), even if it is “only” imported as grey hydrogen in short term.

In other countries with a relevant natural gas production level or well-implemented gas infrastructure such as the Netherlands, the United Kingdom (UK), Norway or Russia blue hydrogen is believed to contribute in short- and medium-term. Some countries such as Germany, the European Union (EU) and Russia have developed a technology-neutral approach open for a large variety of different options. Nevertheless, Germany plans to install an electrolysis capacity of 10 GW by 2030, and the European Union of 40 GW, giving room for an early large share of green hydrogen [8] [16].

Fig. 3: Hydrogen colour preferences of selected national hydrogen strategies

Long-term focus on green hydrogen

In the long-time perspective after 2030, the global focus visibly shifts to the production and use of green hydrogen. In particular, Germany and the European Union including most EU Member States stick out visibly in their ambition to focus on green hydrogen from renewable sources, reflecting the European zero CO2 emission policy by 2050. In this way, an attempt is made to use the many advantages of green hydrogen and to achieve several energy policy goals at the same time. On the one hand, green hydrogen can be used effectively for climate protection in sectors that are difficult to decarbonize, such as heavy-duty transport or steel industry and on the other hand, to improve the flexibility of the energy system. It can also reduce dependence on fossil fuels, promote economic growth and create new jobs [17].

The production of blue hydrogen shall be eventually phased-out stepwise in long-term or otherwise be marginalized. By 2030, turquoise hydrogen from methane pyrolysis is seen as a bridging technology by 2030 in the national strategies specifically in Germany and the EU. The only longer-term perspective for turquoise hydrogen has been mentioned by Russia so far [15].

Perspectives of a future hydrogen supply

In addition to the domestic production of hydrogen, also (green) hydrogen imports (or exports from countries rich in renewable energy) have gained strategic importance. Specifically countries with large industry intensity such as Germany, Japan or South Korea will depend on hydrogen imports. In contrast Australia, Chile, Portugal, Spain, Morocco or Ukraine with high solar or wind potentials, understand hydrogen as an energy carrier for renewable energy with high economic potential [15].

It is obvious that new energy partnerships will develop, which can be observed already today. Both bilateral agreements between individual countries as well as superordinated regional cooperations will be needed in the future. An example for the first one is the cooperation between Australia and Japan for providing grey/blue hydrogen in the short-term and liquefying and shipping it to Japan at large scale [18] [19] or the declaration of cooperation between Germany and Ukraine to develop an energy partnership focusing on hydrogen among others [20].

The second option is reflected by the extensive EU programs currently in preparation to support innovative H2-projects such as e.g. the “Important Projects of Common European Interest“ (IPCEI), aiming at explicitly strengthening the cooperation of individual member states in superregional projects [21]. As this approach is technology neutral a harmonisation process is needed in respect to hydrogen quantities, type of hydrogen carrier (either gaseous or liquefied hydrogen versus hydrogen derivatives such as methane or liquid fuels versus ammonia or methanol), hydrogen colour (i.e. remaining CO2 burden) as well as transport routes and relevant future infrastructures.

Sufficient renewable energy potentials in Europe

From the European perspective, a number of criteria and open issues will have to be respected and/or decided to clarify important aspects of a large-scale hydrogen energy infrastructure, specifically with a view to the hydrogen import/export relations. The availability of renewable electricity to produce hydrogen in the EU or in Europe, in other words the green hydrogen potential, is paramount to be assessed for a fully green hydrogen portfolio in the long-term.

According to [22] the renewable electricity production potential within EU-27 and the UK amounts to a total of about 14,000 TWhel/a, the major share contributed by fluctuating wind (ca. 9,000 TWhel/a or 64%) and solar electricity (ca. 3,700 TWhel/a or 26%). In addition, this estimate is rather conservative as further potential might become available through the use of additional areas for PV plants and so-called floating technology for wind offshore.

Putting today’s electricity demand of ca. 3.000 TWh/a into perspective, it is found that close to 80 % of the total RES potential becomes available for further electrification of the energy system, e.g. for mobility (battery electric vehicles) or room heating (electrical heat pumps) as well as for the production of green hydrogen via electrolysis (Fig. 3). In view of the 2045 policy target of climate neutrality the electricity demand for direct electricity use and hydrogen production in Europe will sum up to 5,300-6,900 TWh/a [22]. Depending on the individual scenario, this would then be less than half of the total REN-potential as explained before. Further hydrogen quantities could be added as potential imports from neighbouring countries and regions such as Norway, North Africa but also Ukraine.

Fig. 4: Renewable electricity potential and electricity use in Europe

The findings of the above analysis show that the renewable electricity potential in Europe is sufficient to satisfy all demand for green hydrogen. For future discussions on green hydrogen import/export, it will thus not be Europe’s renewable electricity potential becoming the ceiling for domestic production. Instead, the focus should be directed at further criteria such as technical, economic, social and strategic hydrogen supply aspects such as hydrogen cost along full supply chains, energy supply independency, local value creation, political stability, established political relationships and public acceptance.

Of course, this relationship does not apply to every Member State, since both the renewable energy potential and the energy demand are unevenly distributed. Countries with high energy consumption such as Germany or the Netherlands will still be dependent on imports, which can, however, be served within the EU from countries with high RES potential such as Spain, Portugal or France.

Advantages of a “merit order“ for hydrogen supply in Europe

In this context, the future hydrogen production mix will become an important, but currently not fully resolved aspect of future regional energy systems with hydrogen as one of major energy carriers. In contrast to natural gas, the advantage of hydrogen is that it can also be produced regionally in modular electrolysers with similar efficiency as in large electrolysers around the globe. Due to its physical properties, hydrogen is similarly well transportable and storable as methane and – depending on the electricity source – can be produced at low cost. Both aspects will become relevant for the “Merit Order” for hydrogen supply seen from a regional perspective and could virtually turn it upside down in coparison to today’s fossil and centralised energy supply system.

Fig. 5: Supply options for a green hydrogen “merit order“, e.g. from the perspective of Mitteldeutschland [25]

Fig. 5 illustrates considerations for a “merit order” for green hydrogen supply given different supply options for a potential case of Central Germany (Mitteldeutschland) [25]. To benefit from an individual region’s opportunities in a robust way, (green) hydrogen supply should have more than one pillar. Providing hydrogen from regional renewable electricity should have highest priority from a local value creation standpoint, supplemented by national hydrogen sources imported from renewable energy rich regions e.g. by existing or refurbished hydrogen pipeline infrastructure with the ambition to safeguarding existing assets. In the case of Mitteldeutschland this could be hydrogen from on- and offshore wind in Northern Germany (e.g. in the federal state Mecklenburg-Vorpommern) through a pipeline.

Any further hydrogen demand surpassing the available local, regional and national energy resources need to be imported from farther away locations, such as other parts of the EU (e.g. from solar or wind power in Spain) or geographical Europe (e.g. from wind in East or Northern Europe) or even outside of Europe (e.g. from solar power in North Africa) simultaneously strengthening the European wide hydrogen pipeline infrastructure.

Should even these sources not prove to be sufficient e.g. during the transition phase then green hydrogen could be imported from other international resources yet at lowest priority. The long-distance import options would contribute to establish global hydrogen partnerships and a global hydrogen market, possibly lowering the global hydrogen energy price not only for industrialized countries.

Furthermore, hydrogen production costs are not the only criterion for decisions on hydrogen supply options. Other criteria such as independence, political stability, flexibility of the energy system and local value creation will come into play. Telling from the recent national hydrogen strategies, this paradigm shift has not been well understood, such that rethinking a sustainable energy system for the future by industry and politics is overdue.

Green hydrogen as local and global opportunity

Hydrogen has been identified as a central element of a future climate neutral energy system in Europe. It will facilitate the integration of renewable electricity and improve the security of energy supply. Moreover, hydrogen will generate economic welfare and entail new jobs. Even though fossil-based hydrogen is produced at large scale already today for industrial applications renewable hydrogen has been earmarked to replace the fossil-based processes by water electrolysis from renewable electricity.

Only Power-to-X concepts will fully exploit all advantages of a hydrogen-based energy system becoming the basis for a sustainable and lasting transition of the energy system. In the transition period until 2030, also low-carbon technologies using fossil energy such as e.g. natural gas through steam reforming enhanced by CCS (blue hydrogen) or methane pyrolysis (turquoise hydrogen) in some regions will activate the hydrogen market lowering the initial cost burden to develop large-scale gas infrastructures. However, in the long term, i.e. by 2050, Europe will push towards green hydrogen.

Analysis has proven that Europe‘s renewable electricity potential is sufficient for a self-sustaining renewable hydrogen supply, which will extend the considerations of import-export relations for green hydrogen. Further criteria addressing technical, social and strategic aspects will receive growing attention. For a region-specific evaluation the so-called “merit order“ of hydrogen supply need to be developed as multi-criterion analysis. It will be focused on nearby renewable energies and fill up the gap between regionally exploitable renewable energy potential and energy demand by green hydrogen from farther away regions. This approach will help to exploit and combine the different regional strengths and opportunities of hydrogen from different world regions.

We interpret the results of a recent analysis by the International Renewable Energy Agency (IRENA) [26] as first international evidence for the expected paradigm change. In a central graph the following four aspects have been illustrated from the viewpoint of an emerging European hydrogen energy market:

- By 2050, hydrogen will be preferably provided from renewable energy sources within Europe (4,771 PJ/a),

- All hydrogen imported to Europe will preferably be transported cost efficiently by pipeline from neighbouring North Africa (2,382 PJ/a),

- Whereas only small quantities of ammonia are expected to be produced within Europe (136 PJ/a), a significant percentage will again be imported from North Africa by ship (1,606 PJ/a), further yet smaller quantities also from South America and the Near East.

- The ammonia vectors are believed not to be applied for hydrogen transport (H2 derivative), but for later end-use as base chemical and here preferably for fertiliser production.

Yet, many aspects surrounding the production of (green) hydrogen have not been finally solved and require further analysis and instruments. Among others, an international hydrogen market will need to be established with an optimum balance between domestic hydrogen production and imports. In order to integrate Power-to-X concepts into international energy markets adequate regulations will have to be developed and agreed for safe and transparent hydrogen handling (e.g. certificates of origin as suggested by the European CertifHy project [24]).

Even though CO2 emissions will become the new currency in a future energy system lock-in effects (e.g. blocking investments and trained workforce, who would develop green technologies instead) from investing in durable but non-sustainable technologies (e.g. to produce blue hydrogen) need to be avoided. Green hydrogen based on renewable energy is one of the keys to achieve the 1.5 °C target from the Paris Agreement in a sustainable, socially acceptable and cost-effective manner.

Literature: To be acquired at Hydrogeit Verlag or from the authors

- European Commission: The European Green Deal. COM(2019) 640 final, Brussels, December 11, 2019.

- International Energy Agency (IEA): Net Zero by 2050. A Roadmap for the Global Energy Sector. Paris, 2021.

- German Constitutional Court (BVerfG): Sentence of the Erste Senat, March 24, 2021, 1 BvR 2656/18, Rn. 1-270, March 2021.

- German Federal Constitutional Court (BVerfG): Verfassungsbeschwerden gegen das Klimaschutzgesetz teilweise erfolgreich. Press release No. 31/2021 from April 29, 2021.

- Rechtbank Den Haag: Judgement May 26, 2021. Case number C/09/571932, Cause list number HA ZA 19-379,

https://uitspraken.rechtspraak.nl/inziendocument?id=ECLI:NL:RBDHA:2021:5339 (accessed May 31 2021). - International Energy Agency (IEA): The Future of Hydrogen. Seizing today’s opportunities. Report prepared by the IEA for the G20, Japan. 2019.

- Cihlar, J.; Villar Lejarreta, A.; Wang, A.; Melgar, F.; Jens, J.; Rio, Ph.: Asset Study. Hydrogen generation in Europe. Overview of costs and key benefits. Luxembourg, 2020.

- European Commission: A Hydrogen Strategy for a Climate Neutral Europe. COM(2020) 301 final, Brussels, July 8, 2020.

- Trinomics, Ludwig-Bölkow-Systemtechnik (LBST): Sector integration – Regulatory framework for hydrogen. Bericht an die Europäische Kommission (DG Energy), 2020.

- Deutsches Biomasseforschungszentrum (DBFZ): Kleintechnische Biomassevergasung, Option für eine nachhaltige und dezentrale Energieversorgung. Leipzig, 2013.

- Albrecht, U., Altmann, M., Barth, F., Bünger, U., Fraile, D., Lanoix, J.-Ch., Pschorr-Schoberer, E., Vanhoudt, W., Weindorf, W., Zerta, M., Zittel, W.: Green Hydrogen Pathways Study (GHyP Study). Joint study on hydrogen from renewable resources in the EU for FCH-JU by Ludwig-Bölkow-Systemtechnik and Hinicio, July 2015.

- Prinzhofer, A.; Cissé, C.S.; Diallo, A.B.: Discovery of a large accumulation of natural hydrogen in Bourakébougou (Mali). In: International Journal of Hydrogen Energy, 43 (2018), H. 42, pp. 19315-19326.

- Cathles, L.; Prinzhofer, A.: What Pulsating H2 Emissions Suggest about the H2 Resource in the Sao Francisco Basin of Brazil. In: Geosciences 10 (2020), H. 4, p. 149.

- Bünger, U.; Michalski, J.; Schmidt, P.; Weindorf, W.: Wasserstoff – Schlüsselelement von Power-to-X. In: Töpler, J.; Lehmann. J. (Editors): Wasserstoff und Brennstoffzelle. Berlin: Springer Vieweg, 2nd edition, 2017, pp. 327-368.

- Albrecht, U.; Bünger; U.; Michalski, J.; Raksha, T.; Wurster, R.; Zerhusen, J.: International hydrogen strategies. A study by Ludwig-Bölkow-Systemtechnik GmbH commissioned by and in cooperation with the World Energy Council Germany. 2020.

- Bundesministerium für Wirtschaft und Energie (BMWi): Die Nationale Wasserstoffstrategie. Berlin, 2020.

- Trinomics, Ludwig-Bölkow-Systemtechnik (LBST): Opportunities for Hydrogen Energy Technologies considering the National Energy & Climate Plans. A study for Fuel Cells and Hydrogen 2 Joint Undertaking, Reference number: FCH / OP / Contract 234, Rotterdam, 2020.

- Ministers for the Department of Industry, Science, Energy and Resources: Australia, Japan agreement an exciting step towards hydrogen future. Press release, January 10, 2020.

- Kawasaki: Major Milestone for Victoria’s World-First Hydrogen Project. Press release, URL:

https://global.kawasaki.com/news_210312-1e_1.pdf (accessed 31 May 2021). - Bundesministerium für Wirtschaft und Energie (BMWi): Gemeinsame Absichtserklärung zwischen der Regierung der Ukraine und der Regierung der Bundesrepublik Deutschland über den Aufbau einer Energiepartnerschaft. Berlin, 2020.

https://www.bmwi.de/Redaktion/DE/Downloads/G/gemeinsame-absichtserklaerung-zwischen-der-regierung-der-ukraine-und-der-regierung-der-bundesrepublik-deutschland-ueber-den-aufbau-einer-energiepartnerschaft.pdf?__blob=publicationFile&v=4 (accessed 31 May 2021). - Bundesministerium für Wirtschaft und Energie (BMWi): „Wir wollen bei Wasserstofftechnologien Nummer 1 in der Welt werden“: BMWi und BMVI bringen 62 Wasserstoff-Großprojekte auf den Weg. Press release, May 28, 2021.

- Trinomics, Ludwig-Bölkow-Systemtechnik (LBST), E3M: Impact of the use of the biomethane and hydrogen potential on trans-European infrastructure. Study for the European Commission , DG Energy, Brussels, 2020.

- Brändle, G.; Schönfisch, M.; Schulte, S.: Estimating Long-Term Global Supply Costs for Low-Carbon Hydrogen. Institute of Energy Economics at the University of Cologne gGmbH (EWI) Working Paper No. 20/04, 2020.

- CertifHy: Designing the first EU-wide Green Hydrogen Guarantee of Origin for a new hydrogen market,

https://www.certifhy.eu/project-description/project-description.html (accessed 31 May 2021). - [IRMD 2022] Ch. Kutz, U. Bünger, W. Weindorf, L. Reichelt, J. Moll, R. Schultz, D. Schultz, R. Kirchner, C. Dinse, St. Klingl, F. Pothen, P. Borovskikh, H. Ventz, L. Samartzidis, B. Klement, L. Schubert, Ch. Klöppelt, St. Bergander, J. Renno: Potenzialstudie Grüne Gase – Analyse und Bewertung der Potenziale Grüner Gase

in der Innovationsregion Mitteldeutschland. Project report for the Metropole Region Mitteldeutschland,

https://www.innovationsregion-mitteldeutschland.com/wp-content/uploads/2022/04/220209_Potenzialstudie_Gruene_Gase_Gesamtbericht.pdf (accessed 21 April 2022). - [IRENA 2022], Global hydrogen trade to meet the 1.5°C climate goal: Part I – Trade outlook for 2050 and way forward, International Renewable Energy Agency, Abu Dhabi, 2022.

0 Comments

Trackbacks/Pingbacks