DNV study analyzes establishment and costs

The energy transition in Europe can only succeed if CO2-intensive sectors are rapidly decarbonized as well. In this, green hydrogen will very likely play a central role. Because in many energy-intensive applications, there is no other CO2-neutral alternative. The quantities of hydrogen required to achieve climate neutrality are very high for Europe, however. For decarbonization of today’s H2 production in Europe, about 250 TWh of H2 would be needed. In its hydrogen strategy, the EU assumes an availability of 2,250 TWh by 2050.

As the energy crisis in the previous year showed, dependence on imported energy sources is strategically risky. In this respect, larger quantities of hydrogen should be produced in Europe in order to avoid falling into comparable dependencies to that today with fossil energy sources.

In this context, as an independent technological consulting firm in Germany, DNV has investigated for gas grid operators Gascade and Fluxys the extent to which offshore hydrogen production is economically and strategically sensible and how a large-scale integration of offshore electrolysis into a European grid could make a significant contribution to the supply security of Europe.

Offshore wind energy is most economical

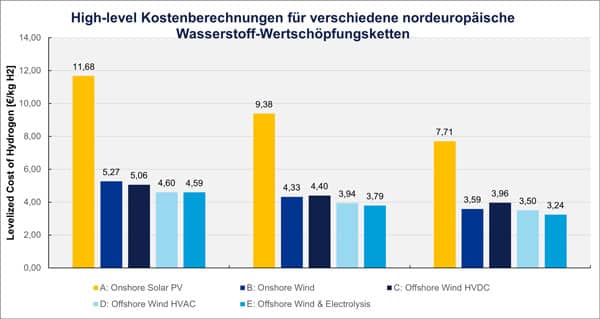

The starting point for the investigations is a comparison of five H2 value chains examined with regard to their H2 generation costs. This assumes production in Central Europe with respect to the wind and solar profiles. Compared are the production chains: onshore wind, onshore PV, offshore wind with onshore electrolysis and HVAC (high-voltage alternating current) or HVDC transmission, and offshore wind with offshore electrolysis and pipeline transmission.

The results of the modeling show that the production of hydrogen by offshore wind energy is in principal the most economical. This is particularly due to the high full load hours – about 5,000 – of the electrolyzer that offshore wind can achieve and through which the capital costs in relation to production become most advantageous.

With the use of offshore wind energy, there is still the question of whether electrolysis should rather take place onshore or offshore. This aspect as well is examined in detail in the study. A comparison of the importance of energy transmission costs on total LCOH (levelized cost of hydrogen) between the three options

1) wired HVAC connection with electrolysis onshore and

2) wired HVDC connection with electrolysis onshore versus

3) pipeline-based hydrogen transmission with electrolysis offshore

shows that up to a distance of about 125 km (78 mi) off the coast, HVAC transmission is more cost-effective compared to HVDC transmission. At distances beyond this, however, pipeline connection is more cost-effective, based on total LCOH. Electrolysis for more distant offshore areas should consequently be carried out offshore. For the study, this limit is drawn at 100 km, as a single pipeline can also integrate several offshore wind farms (see yellow-hatched area in Fig. 2).

If land use, as onshore electrolysis takes up significant area, is considered as a further factor, offshore electrolysis has yet another advantage: The already very intensive land use onshore will not be further intensified. The compact design that is possible offshore is significantly more advantageous.

89 gigawatts in the North Sea in planning

In a next step, the study investigates the offshore wind generation potential for areas in the North Sea and Baltic Sea with a distance to shore of more than 100 km (62 mi). Only those areas are taken into account that have so far been designated for wind projects by the respective countries. The corresponding evaluations show that within the 100 km criterion, 89 GWel of offshore wind energy projects in the North Sea are currently for the most part in the early planning phase. There is still far more potential in the surfaces of the North Sea; however, they are not currently designated for use for wind energy.

If the identified wind potential in the North Sea of 89 GW were to be used exclusively for the generation of hydrogen, then this would correspond to an H2 production volume of around 350 TWh per year, or 9 Mio. tonnes annually. Such a quantity would cover 15 to 20 percent of Europe’s hydrogen demand in 2050, depending on the forecast study used as a basis.

In the Baltic Sea, the potential is significantly lower, at least if the 100 km criterion is stringently applied, because of the shorter distances of the stations from the coast. A deep look at the production potential in the Baltic Sea region was not conducted in the study. However, a corresponding offshore wind backbone in the Baltic Sea could also efficiently drive an onshore H2 production in Sweden and Finland with transmission to Central Europe and additionally be combined with a production at sea.

Differences between natural gas and H2 pipelines

Basing upon the results of the economic viability and the possible potentials from the areas, the study next details the possible technical implementation. Here, it is less about the offshore electrolysis itself, but specifically about options to connect offshore hydrogen production to an onshore grid via an offshore pipeline network. For this, numerous issues need to be addressed, in order to create a hydrogen backbone that can be operated safely.

When comparing for example the transport of natural gas, which is common in offshore environments, with the transport of hydrogen, which has not yet been carried out in offshore environments, several aspects must be taken into account. First, natural gas and hydrogen have different energy contents when they are transported through a pipeline. Natural gas consists mainly of methane (CH4) and normally has an energy content – upper calorific value – between 34 and 43 MJ/m³.

Hydrogen, on the other hand, has a much lower volumetric energy content than natural gas of about 12.7 MJ/m³. This means that when hydrogen is transported through a pipeline, a much larger volume of gas is required to transport the same amount of energy in natural gas. Hydrogen, however, is also a much lighter gas than natural gas.

At normal temperature and pressure, for example, a cubic meter of hydrogen has about one-ninth the mass of a cubic meter of natural gas, which results in a much higher flow rate at the same pressure differences. The combination of these two aspects – low calorific value and light weight – has an equalizing effect, so the energy transmission of hydrogen and that of natural gas are nevertheless similar.

Furthermore, hydrogen has a much higher diffusivity in steel than natural gas and therefore promotes the embrittlement of pipelines following cyclic loadings. This effect can be controlled by an avoidance of cyclic loading, using lower quality steels, – which are softer and therefore less susceptible to cracking – and using a thicker pipeline wall. This also generally limits, however, the ability to reuse existing natural gas pipelines for hydrogen transport.

Taking all this into consideration, the study therefore comes to the conclusion that due to its different volumetric, gravimetric and molecular properties, the transport of hydrogen differs greatly from that of natural gas in offshore pipelines. Offshore hydrogen pipelines should therefore fulfill specific design criteria in order to ensure adequate transport capacity and to be able to operate safely and enduringly. On the basis of the analyses carried out, whose key points alone are treated in this article, the authors conclude that a repurposing of existing offshore pipelines is in most cases uneconomical, especially if the pipeline is to be part of an integrated system and connect several wind farms.

High pressure level possible

As a final step, the study details the technical implementation of a hydrogen backbone in the North Sea. Discussed are, among other things, questions regarding pipeline routing and pressure regimes as well as pipeline costs and required storage capacity as a result of fluctuating H2 production. The transport network sketched in the study connects wind farms in the North Sea with onshoring points in six countries bordering the Sea. For the connection, terminal points on the planned onshore backbones in the countries were selected. The network thus formed has a total length of 4,500 km (2,800 mi) and generally has a north-to-south flow direction.

In the study, a complete hydraulic analysis is not performed, but rather a few approximate calculations. In order to, for example, determine the required feed-in pressure for the transport of hydrogen from Norway to Germany, corresponding calculations were carried out for the necessary pipeline sections (see Fig. 3).

The assumed pipe diameter is 48 inches (1,200 mm). With these parameters, the required feed-in pressure was calculated for different capacities of the pipeline. For an H2 capacity of 25 GW connected to this pipeline section, for example, an inlet pressure of 192 bar is calculated. This is a very high pressure level for offshore H2 pipelines.

The DNV joint industry project (JIP) H2Pipe at this time is investigating the design, construction and operation of offshore H2 pipelines with a pressure of up to 250 bar. Although these pipelines are not commercially available yet, DNV and the JIP partner companies see no major technical constraints to the realization of such pipelines. The economic feasibility in terms of material selection for the pipelines and ancillary equipment, however, will have to be demonstrated in the coming years.

In addition to the pipeline system, the storage demand is also analyzed in the study. Connection to sufficient storage capacity is necessary for near-continuous supply over time. On this, the study shows that about 30 percent of the annual production must be stored, as a prerequisite for this H2 supply based on fluctuating renewable energies. The study accordingly assumes a connection to salt cavern storage facilities in northern Germany and the Netherlands.

Cost calculation

The costs for the outlined network were subsequently estimated. For the North Sea, the total length of the planned backbone is 4,200 km (2,600 mi). Assuming a pipe diameter of 36 to 48 inches (910 to 1,200 mm), the price thus lies between 3,000 and 4,500 euros per meter of pipeline.

According to the assumptions made, the additional LCOH for the pipeline system is between 0.13 and 0.20 EUR per kg hydrogen, i.e. 4.0 to 6.6 EUR per MWh. Since the levelized total cost of offshore hydrogen is 3 to 5 EUR per kg, this means an addition of only 2.6 to 6.7 percent, based on direct production costs.

In addition to pipelines, an appropriate compression regime must be considered. The cost of a compressor varies considerably with the size. The maximum capacity of today’s compressors is about 16 MWel (input capacity). Under the assumption of central compressors for a wind farm; an output pressure of the electrolyzers of 30 bar; an input capacity of the hydrogen backbone of 200 bar, and an arrangement of four compressors, each with 50 percent of the total capacity required and 200 percent of the installation costs; the investment amounts to 46 million EUR for a 1‑GWel wind farm and 66 million EUR for a 2‑GWel wind farm. Thus, the additional LCOH is between 0.06 and 0.08 EUR per kg hydrogen, which corresponds in value to 2.0 to 2.7 EUR per MWh. Since the levelized total cost of offshore hydrogen is 3 to 5 EUR per kg, this means an addition of 1.2 to 2.7 percent.

Overall, the cost for the pipeline and compression is around ten percent of the total specific cost of hydrogen. In addition to pipeline and compression costs, the storage must also be considered as a third component to be added to the LCOH. The result is an additional 0.22 to 0.35 EUR per kg H2 for this.

With the determined system components, the investment costs were estimated in the study as 35 to 52 billion euros to build the outlined North Sea hydrogen backbone. In conjunction with the results of the LCOH analysis, hydrogen from North Sea offshore wind farms can be supplied to Central Europe with it at specific costs of about 4.69 to 4.97 EUR per kg in year 2030. From the point of view of the authors, these costs are competitive with the cost for imports.

In order to implement the outlined system, a coordinated and swift action by the coastal nations involved is imperative. Only so can the necessary network and scaling effects be realized, and an offshore backbone contribute to hydrogen supply to Europe by 2050.

Authors: Claas Hülsen, Ton van Wingerden, Daan Geerdink

0 Comments