The potential of methanol

Methanol is already one of the most important basic materials for the chemical industry and will become even more important in the coming decades – for plastics of all kinds as well as for the production of e‑fuels. For this, large quantities of green hydrogen and sustainably produced CO2 are required.

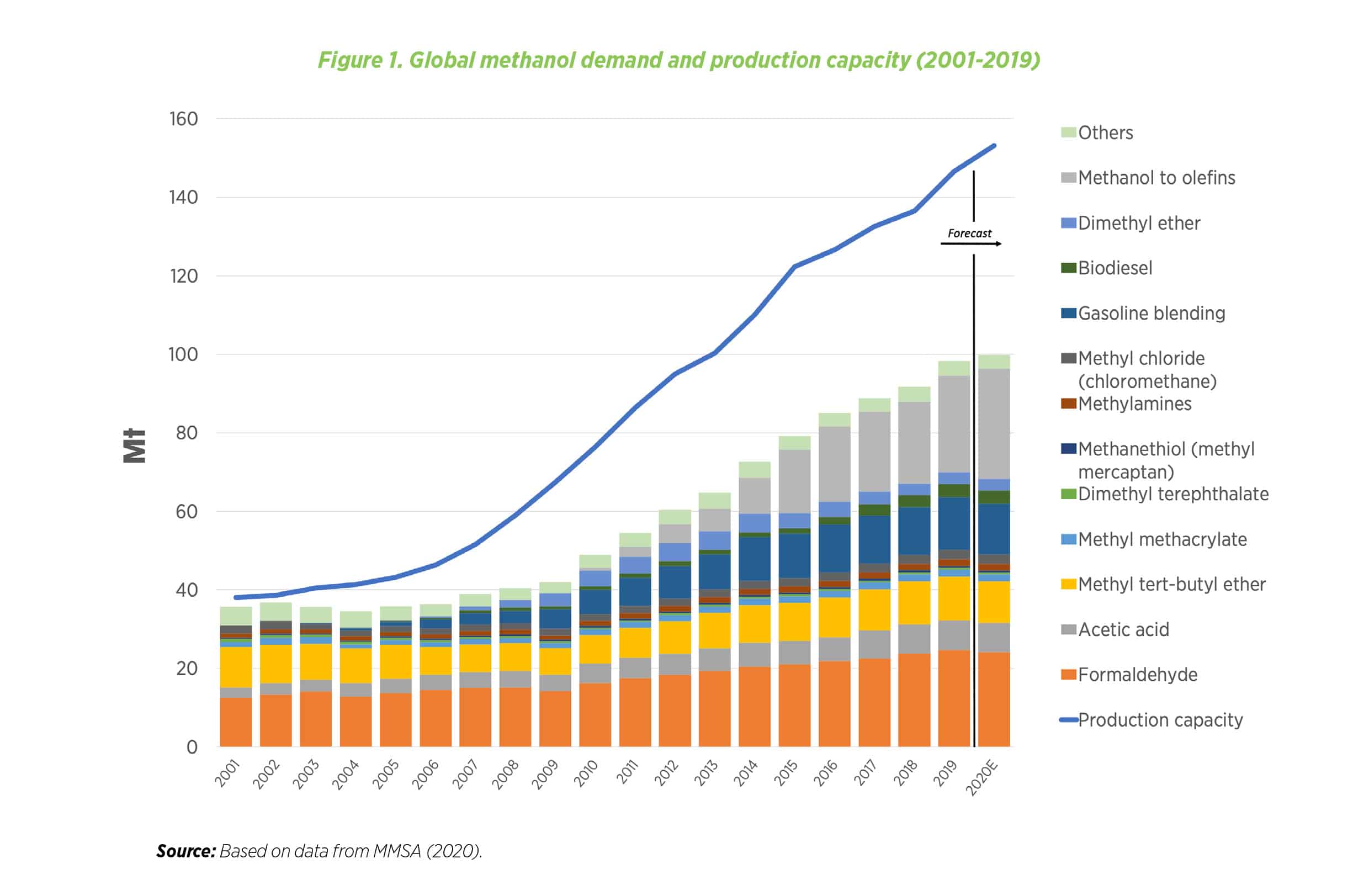

Formaldehyde, acetic acid, silicone, olefins – these intermediate products in the chemical industry generally require methanol as a base chemical. The report “Innovation Outlook: Renewable Methanol” published by the industry association Methanol Institute and the International Renewable Energy Agency (IRENA) in 2021 put the global annual production of the basic material at 98 million metric tons. Trend: quickly rising.

The main driver, according to the report, is the Chinese chemical industry. On top of that, the versatile alcohol is increasingly powering vehicles on land and in the water – in special engines or fuel cells, or converted to e‑fuels.

By 2050, the global production could lie at 500 million tonnes annually, estimates IRENA and the Methanol Institute. If these are generated from natural gas and coal, like so far, the greenhouse gas emissions from methanol production would rise from the current 0.3 Gt of CO2 equivalents to 1.5 gigatonnes per year.

Likewise to electricity generation, methanol production therefore also needs a new basis. According to a well-to-wheel analysis, a switch to green methanol would reduce emissions by 65 to 95 percent. E‑methanol, so methanol produced with the aid of electrolytically generated hydrogen, is significantly better at this on average than biomethanol.

Methanol increasingly important as a fuel

Green alcohol has great potential for a climate-friendly economy. “Renewable methanol is one of the easiest-to-implement sustainable alternatives available, especially in the chemical and transport sectors,” says the report. It is easy to store and transport, and can be almost seamlessly introduced into industry.

The role of methanol as a fuel has already been growing since the mid-2000s. For one, it is the basis for biodiesel and serves as a base material for antiknock agents. From gasoline to LPG, methanol can also be blended with a wide variety of fuels in relatively large quantities. And this happened too during the oil crises in the 1970s and 1980s.

In recent years, the role of pure methanol in particular as a fuel has grown. In China and Israel, trucks with methanol drives are already on the roads. The combination with direct methanol fuel cells has also been tested, both as a drive on its own and as a range extender for e‑vehicles.

On the sea, methanol could replace the sulfur-containing marine diesel. That would not only spare the air a lot of CO2, but also sulfur and nitrogen oxides. At the time of the study, the authors counted already more than 20 large methanol ships in operation or on order. One example is the Stena Germanica, a 50,000-tonne, 32,000-horsepower ferry that travels between Germany and Sweden. She was converted to run on methanol in less than three months.

In addition to methanol, ammonia is also considered a promising candidate for green sea travel (see H2-international May 2022).

E‑methanol needs mega-electrolyzers

At the time of the study, the team of authors recorded only 0.2 million tonnes of methanol from renewable sources, primarily from biomass. But biomass is finite, even when wastewater, black liquor and household waste are made use of as sources. Almost unlimited, in contrast, is the abundance of wind and solar energy. E‑methanol from electrolytically produced hydrogen will not be avoidable in the long term.

The recipe: For one tonne of green e‑methanol, take 0.19 t hydrogen and 1.38 t carbon dioxide. Separate the latter from the air or from exhaust gas or biogas plants. To generate the required hydrogen, feed an electrolyzer with 1.7 tonnes of water. In addition, you need ten to eleven megawatt-hours of wind or solar power, mainly for the operation of the electrolyzer.

With a 100-MW electrolyzer – which can be acquired for example from Thyssenkrupp or Siemens Energy – it is possible to produce 225 tonnes of e‑methanol per day, the report calculates. The largest of today’s methanol plants are about a factor of ten larger in capacity, so electrolyzers in the gigawatt range would be needed. This level of scaling is still in progress.

The cost question: It depends

Until green methanol can compete with fossil in terms of price, some things still have to happen. Like so often, the economic efficiency depends on many rapidly changing factors, from the electricity costs to the investment in the electrolyzer, to a cheap CO2 source.

The cost of producing methanol from fossil fuels was put as 100 and 250 USD per tonne in the report, which however was compiled some while ago. Market prices in the first quarter of 2023 lay between 300 and 600 USD per tonne, according to the Methanol Institute. The study team at the time estimated the cost of biomethanol at 320 to 770 USD per tonne, which process improvements, they suggested, could lower to 220 to 560 USD.

In comparison, e‑methanol from green hydrogen has had it hard, since both electrolysis with renewable energies and CO2 capture are still not mass technologies. To fish CO2 out of the air would easily cost 300 to 600 USD per tonne. Catching it in a bioenergy plant, on the other hand, could be done for 10 to 50 USD per tonne.

The hydrogen price depends on, in addition to the costs for the electrolyzer, the costs for electricity generation in particular. Roughly speaking, the authors calculate: So far, one tonne of e‑methanol would cost 800 to 2,400 USD, and by 2050, the cost for it could reduce to 250 to 630 USD.

When and if the costs of e‑methanol and fossil methanol will meet is dependent on the scaling speed as much as on CO2 prices and energy market dynamics.

Methanol in a nutshell

With only one OH group and one hydrocarbon group, methanol is the chemically simplest of the alcohols. It is liquid at ambient conditions, water soluble, colorless and smells slightly alcoholic.

Methanol in small amounts occurs naturally in food and the atmosphere. In the past, it was obtained as a byproduct of charcoal production, which is why it also has the name wood spirit or wood alcohol.

In comparison to gasoline or diesel, the volumetric energy density of methanol is about half as high. It freezes at −97.6 °C, boils at 64.6 °C and has a density of 0.791 kg per cubic meter at 20 °C. When pure methanol is combusted, practically no smoke, soot or odor develops.

Methanol is highly flammable and corrosive. On top of that, it is toxic. So are other fuels, but it rarely comes up, since no one would think of drinking gasoline or diesel, whereas methanol is increasingly used to adulterate alcohol.

Commercial e‑methanol production still in the early days

Around the world are first projects for the production of e‑methanol. Most of these involve pilot and research plants with small capacities. In a search for commercial projects, one company comes up again and again: Carbon Recycling International (CRI) from Iceland.

CRI started up a commercial e‑methanol plant back in 2012, according to its own information. It is located in Svartsengi next to the famous Blue Lagoon and a geothermal power plant. Along with hot steam, dissolved CO2 and hydrogen sulfide come up to the earth’s surface – the last provides the typical smell of rotten eggs at Iceland’s hot springs.

Inspired by the energy source, the trademarked name of the product is Vulcanol. With after all 4,000 tonnes annual production, this plant can be considered the first industrial plant for e‑methanol. The hydrogen for the process comes from alkaline electrolysis.

The large project at a coke plant in the Chinese city of Anyang – 110,000 tonnes annual production – also links back to CRI. An electrolysis with green electricity is not present there, however. Rather, the coke oven gas contains methane, hydrogen and CO2 – the compounds for methanol production. According to CRI, the plant has been in operation since the third quarter of 2022.

Another plant, likewise in China, is to go into operation before the end of 2023, in order to obtain 100,000 tonnes of methanol annually for plastic production out of CO2 and hydrogen from a petrochemical complex. A primary user and the owner will be Jiangsu Sailboat.

The first large-scale plant in Europe could appear in Finnfjord in northern Norway, and utilize CO2 from a ferrosilicon plant and green hydrogen from an electrolysis station. The investment decision, however, is not scheduled to take place before 2024. In addition, CRI mentions in its reference list four older projects, which were part of the EU research support program Horizon 2020.

Small off-the-shelf methanol plants

The Leipzig-based firm BSE Engineering offers, under the product name FlexMethanol, standardized small-scale plants for e‑methanol production. Input powers of 10 and 20 MW depending on module are possible, which can be combined for a system up to 100 MW, according to the brochure. As target groups, the company names waste incineration plants, paper mills, fossil fuel-fired power plants and all heating processes.

The process consists of four steps: the electrolysis, CO2 capture (scrubbing), the methanol synthesis itself and distillation.

BSE Engineering is responsible for the integration of the entire methanol plant, and furthermore, according to the brochure, is the exclusive supplier of catalysts developed by BASF for the methanol synthesis. Also on-board are AkerSolutions for the CO2 extraction, InvraServ-Knapsack for the detail engineering and Sulzer for the distillation. For the electrolysis, there is no fixed partner.

E‑methanol from the wastewater treatment plant

In October 2022, the company Icodos was spun off from KIT (Karlsruhe Institute of Technology). The goal: To generate e‑methanol from CO2 point sources such as biogas that develop in wastewater treatment plants, in addition to pure biomethane for the natural gas grid in the case of biogas. Besides the biogas, hydrogen is required for this.

The methanol-water mixture produced from the reaction of CO2 and hydrogen absorbs CO2 from the previously purified biogas. Remaining in the gas is methane, which can be fed into the natural gas grid. The dissolved CO2, in turn, is expelled from the solvent by feeding in hydrogen, and is converted to methanol and water in a synthesis reactor. Some of this product is fed back into the loop and can thus serve as an absorbent over and over again.

A pilot plant funded by the German research ministry is in the construction phase, and is to be tested at KIT at the end of the year. Following that, it is to be tried out on real biogas in the sewage plant in Mannheim (Mannheimer Kläranlage). This is to be followed by a larger test together with EDF (Électricité de France) in France. A rollout could still be possible within this decade. The typical size for the plants is expected to be in the one- to two-digit megawatt range in terms of electrolysis capacity.

Institutes and chemical companies working together

In Germany, there is a whole series of research projects concerned with obtaining methanol from green hydrogen. In most cases, established research institutes and large refining or chemical companies are working together in this. The overview compiled here makes no claim to completeness.

Westküste100/Raffinerie Heide: At a real-world H2 lab in Heide in the state of Schleswig-Holstein, a consortium aims to investigate a whole range of hydrogen technologies – from cavern storage to methanol synthesis (see H2-international Oct. 2020). The last is to take place at Raffinerie Heide. The CO2 is to come from a cement plant, the hydrogen from an electrolysis plant. However, the final project description regarding methanol synthesis still only mentions a feasibility study. The challenge, it is said, is to integrate the large-scale process that takes place between the cement plant and the refinery. Responsible for the corresponding work package is Thyssenkrupp. The real-world lab is running from 2020 to 2025. A scaling up to “several hundred megawatts” of electrolysis capacity subsequent to the lab, according to the project description, is the goal. In the end, kerosene for Hamburg Airport (Hamburger Flughafen) is to come out of this, is the vision.

HyPe+/Raffinerie Schwedt: Raffinerie Schwedt presented a study in May 2023 together with Enertrag, in which it reveals the refinery in Schwedt could become completely climate-neutral by 2045 (see p. 18). Instead of fossil raw materials, it wants to rely on green hydrogen from the region. Of wind and solar plants, there are plenty in the surrounding area, and a hydrogen pipeline under the project name Flow is planned. The numbers make an impression: 300 MW of electrolysis capacity are to already appear in the first expansion stage, then 400 MW by the end of 2027 with hydrogen production of over 30,000 tonnes. For 2030, the study envisages 160,000 tonnes of in-house hydrogen production; another 80,000 are to be purchased. With this, about a fifth of the quantity foreseen for this period according to the national hydrogen strategy would land in Schwedt. The refinery aims to eventually produce two million tonnes of “aviation fuel, methanol, and high-value chemicals” annually, and another tonne in biofuels along with that. The question of the CO2 source has unfortunately so far remained unanswered.

Chemiepark Leuna/TotalEnergies: At the site in Leuna two years ago, TotalEnergies, Fraunhofer CBP and Fraunhofer IMWS as well as electrolyzer manufacturer Sunfire announced a project with the title e-CO2Met. The Raffinerie Mitteldeutschland located there hosts, according to TotalEnergies, with 700,000 tonnes of methanol per year, the largest methanol production in Europe – completely fossil-based until recently. The high-temperature electrolyzer from Sunfire is, with an input power of 1 MW, comparatively small. Sunfire confirms that it has been in operation since February 2023. An update on the overall project from TotalEnergies was, however, not able to be received.

H2Mare – Methanol production at sea: With distance to the coast grows not only the possible energy yield from offshore wind farms, but also unfortunately the expense for connection to the electric grid – even more so if several cables are necessary because of the high power requirement. That’s why these wind farms could instead produce hydrogen, which can be brought ashore by ship or pipeline, is one idea, among others, taken on in the project Aquaventus Gestalt. The lead project, H2Mare, in which KIT also participates, goes still a step further in one of the four wide-area projects. Directly at sea, the hydrogen is to be processed into ammonia, LNG, methanol or liquid hydrocarbons (e-fuels). One of the project goals is to demonstrate for the first time a complete process for the production of e‑fuels on a floating platform off Helgoland in summer 2025. Such facilities must be able to cope with fluctuating electricity production from wind energy as well as with a swaying platform and weather conditions at sea. The dynamic production of e methanol is being tested by KIT, while H2Mare is only testing the production on land.

H2Mare is pursuing still other approaches: Distillation modules adapted for offshore operation, from the 3D printer, are to separate the methanol from the water that also arises in the process. This saves transport capacity, and the water after treatment should be available again for electrolysis. In the future, the required CO2 could be extracted from the sea by means of electrodialysis, which would simplify the logistics. And the technical university TU Berlin is working on operating an electrolyzer directly with salt water.

OMV Deutschland, Munich: Sustainable aviation fuels (SAFs) based on e‑methanol are the aim of the project M2SAF. The consortium consists of BASF Process Catalysts, the plant manufacturer Thyssenkrupp Uhde, the refinery OMV Deutschland, the German aerospace center (DLR) and the testing lab ASG. The project started in November 2022 and is conceived for two and a half years. Details from Uhde on the quantities and capacities were not to be found.

The e‑methanol projects in Germany so far are varied, but so far rather small. How quickly and whether they scale at all in this country remains to be seen. The will is there, but alone the building of generation capacities for wind and solar power takes time and money. And yet one of the advantages of methanol is that it can be transported around the world by ship without problem. As long as Germany does not completely cover its own energy needs and there is no hydrogen pipeline across the Mediterranean Sea, it is only logical that green methanol will be imported to a significant extent.

Author: Eva Augsten

Source: CRI, Irena/Methanol Institute, Markus Breig, KIT,

0 Comments

Trackbacks/Pingbacks