Setting up various production lines for stacks is at the focus for Ballard Power. With these, the company can act and deliver during the ramp-up in the next years. With still nearly 800 million USD in the bank, Ballard is in a comfortable situation and is able to finance all investments from its own resources. That the company is valued at the stock exchange with only about one billion USD seems incomprehensible in view of the prospects.

Strategically interested companies could and should seize the opportunity and get on board with Ballard stock as long as the stock market valuation is so low. What if a Mr. Adani were to come knocking again? Or automotive suppliers such as Dana, Tyco or Magna? Anything is possible. The only protection against this: significantly higher share prices, so a stock market valuation that matches the future prospects.

Figures have little informative value

Current sales will be dramatically exceeded in the coming years, when the ramp-up of the FC markets for commercial vehicles of all kinds, ships and rail vehicles begins. In this respect, the quarterly losses in 2023 and 2024 are due to high R&D expenses and the expansion of capacity and have little to no meaning. What if in a few years’ time instead of the still scant individual orders of 50, 100, 200 FC modules per year, 1,000, 5,000, 10,000 and more FC modules were to be delivered – and for each individual market? Then Ballard would have the necessary capacities and could deliver.

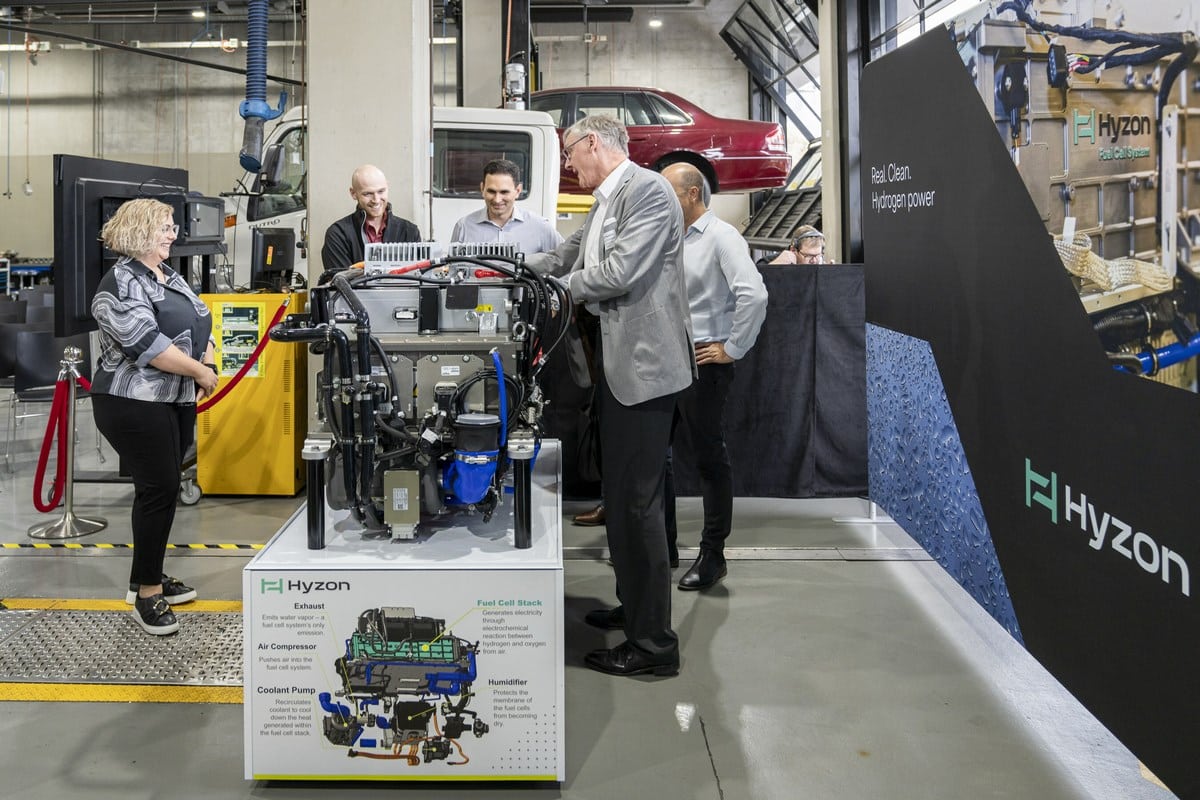

Opening of the Still’s FC production site in location Hamburg

The forklift truck manufacturer Still (subsidiary of Kion, majority-held and part of the Chinese Weichai Group – which in turn holds about 15 percent in Ballard Power) is relying on the FC stacks from Ballard Power. On November 10, 2023 in Hamburg, the ceremonial opening of the first production line for 24-volt fuel cell systems took place. In the future, 4,000 FC forklifts will roll off the production line there every year.

7-billion-dollar hydrogen hub plan

Ballard benefits indirectly from the planned establishment of a US-wide network of seven hydrogen production centers (hydrogen hubs). This is because the widespread production of green hydrogen is a great opportunity for many – and even more so in the future – Ballard customers to invest in products that can use hydrogen: shipping companies, trucks, buses, ships, rail vehicles and many more. In six of the seven hubs, Ballard sees the perfect positioning for itself and its customers in hydrogen and fuel cells.

Forsee Power proves to be a stroke of luck

If you look at the current figures of the French battery manufacturer Forsee Power, you have to give Ballard credit for a good hand with the investment – Ballard is one of the largest single shareholders. A massive 83 percent increase in turnover in the third quarter to 47.9 million EUR. In the first nine months, that amounts to a plus of 67.6 percent to 126.6 million EUR. For the whole year, it is to be 160 million EUR, then 235 million EUR in 2024, and 850 million EUR turnover in 2028 is the goal.

The two companies work perfectly together, as the batteries from Forsee are put to use in, among other things, the FC systems of buses and Ballard customers. Forsee at around 2.50 EUR per share seems to me to be a good buy if you want to have batteries in your portfolio and see it as a complement to the fuel cell.

Solaris is the perfect forerunner

The Polish bus manufacturer Solaris is continuously ordering more FC modules from Ballard, 350 in total this year alone – another 62 were recently added. Since Ballard supplies various bus manufacturers as a partner for the fuel cell, Solaris is a very good example. This market is only at its start, and Ballard as number one and frontrunner already has experience of over 100 million kilometers traveled. The newsletter Information Trends see the market for FC long-haul buses in general as one of the fastest growing hydrogen markets.

In the next 15 years, globally over 73.4 billion USD are to be invested in new FC buses. The forerunner is China. FC buses are becoming increasingly cheaper, even if they’re still more expensive than pure battery-electric buses. Convincing here are the arguments of range and time or type of refueling. Parallel to this, the H2 infrastructure is being established. Consider this: Ballard has more than ten big bus manufacturers that exclusively rely on fuel cells from Ballard. In China, Ballard via a joint venture with Weichai Power is also the supplier for various bus manufacturers there – that is only one of the over 30 platform partnerships. Currently, there are tenders for over 17,000 buses worldwide.

Individual orders increasingly larger

Randy MacEwen as CEO has said: from small series occurs the ramp-up to large series. From batch sizes of 10 to 100, there are now massive numbers. The same goes for many other markets: The rail vehicle manufacturer Stadler reports that they are waiting for the acceptance for 25 hydrogen-powered trains, after having already received a firm order for four such trains in California.

In trucks, OEM partners such as the German company Quantron rely on Ballard: Among other things, they deliver hydrogen-powered small trucks Ikea. The platform partnership with Ford for the F-Max raises great expectations: What would it mean if Ballard were to supply FC modules for over 10,000 trucks per year? It is important to be, like Ballard, a technology leader and also have the ability to deliver (capacities).

My only concern: What happens when a big player in the market takes advantage of the situation and makes Ballard a takeover offer – like Cummins has done with Hydrogenics? A participation in a strategic partnership would be a share price turbo, though.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: Written by Sven Jösting, December 15th, 2023

0 Comments