The decline in the share price of Ballard Power in the past months is ascribed to the impatience of the many investors who assess primarily the short-term potential of this market leader in the PEM FC area. What counts is the long-term outlook of the company.

Current quarterly figures give credit to the skeptics. Ballard itself is not fighting this, as they are working unperturbed on the long-term strategy: establish production capacities, cooperations and pilot projects. This will be accompanied by capital outflows as well as the “logical” losses that it will entail. Ballard has enough capital in the bank to be able to implement the plans without outside pressure: 864 million USD in the bank account speaks for itself.

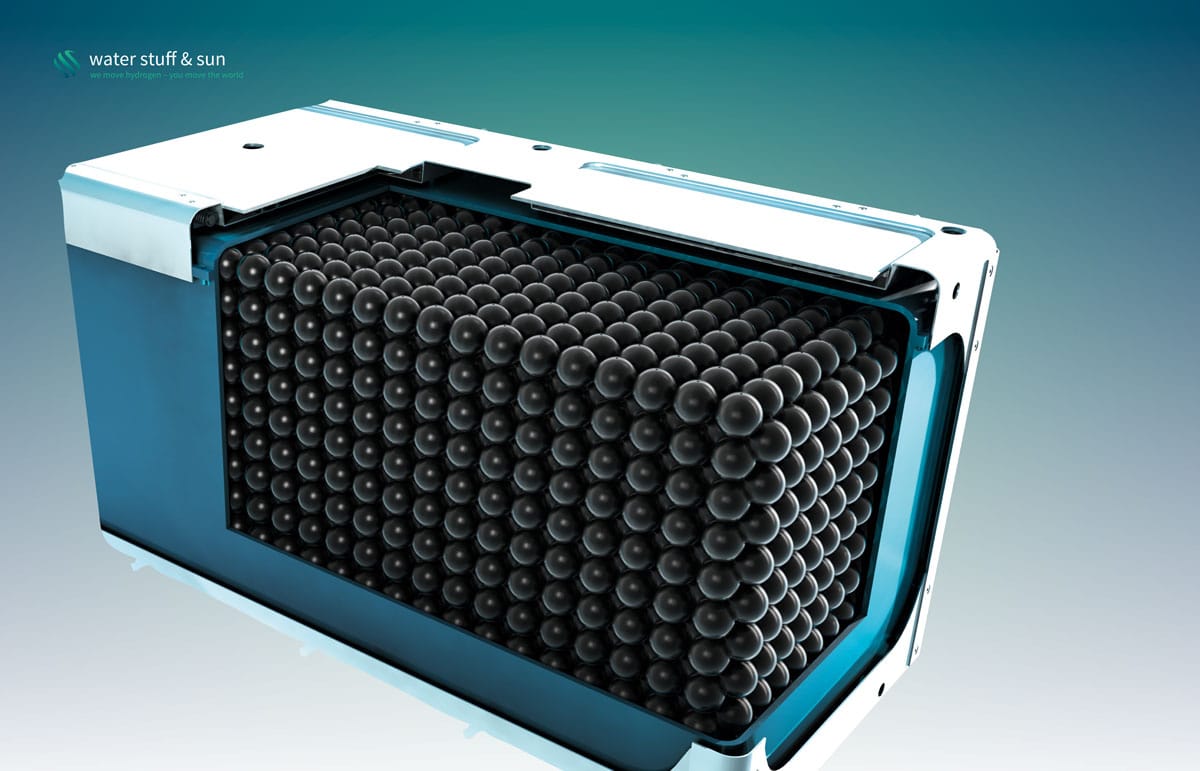

At the same time, Ballard is working on the constant optimization of its technologies, be it the MEA for the fuel cell, the FC modules, or the stacks for various applications, to be among the top suppliers on the market. But how will the stock market react when the production sites in China, Europe, the USA and Canada (eventually also in India – see Cummins with Tata) are utilized to capacity and then promise, in addition to high sales growth, a good profit?

China could be the wild card

Ballard president Randy McEwen is traveling for several weeks through China to meet with representatives of public authorities, ministries, companies, customers and municipalities as well as other players important for Ballard. This is certainly about understanding why China’s H2 support program has yet to be approved. The probably still largest FC stack production facility in the country – operated as a JV by Weichai and Ballard – is still “unemployed.”

That a larger program will come is, for me, no question, as many companies and regions or cities in China have now seized the topic in a variety of ways on their own (e.g. capacities for different electrolyzer types, stacks, vendor parts, FC trucks, H2 pipelines, refueling stations). For these is expected a high growth potential, which ought to be made use of. Perhaps China will still surprise the world with an H2 program in 2023 that not only matches, but makes the equivalent programs in the USA, Europe, Japan and elsewhere look smaller?

What would happen if China also gave passenger car fuel cells a boost with a national quota? China already did this for the battery– in the largest automotive market in the world – with the EV mandate, and all auto companies producing in the country have had to adapt to it. Ultimately, China has provided the foundations for battery-electric mobility worldwide.

By the year 2030, 1 million vehicles refuelable with hydrogen are to be running in China. Perhaps this goal will be adjusted against the South Koreans, since South Korea wants to be able to fuel over 6 million vehicles with hydrogen by 2040. For Ballard, a positive turnaround could come about very quickly from this, which would then also help the share price soar.

150 million kilometers clocked

Ballard meanwhile reports 150 million kilometers driven (93.2 million miles) by commercial vehicles and buses equipped with its technology – and smoothly. Worldwide, 3,800 buses are driving with Ballard inside. The Canadian company is setting an industry and sector standard with this. They are very well positioned in terms of total cost of ownership, according to CEO Randy McEwen.

“At Ballard, we are designing our PEM fuel cell engines for heavy-duty mobility applications where zero emissions, reliability, and durability are key differentiators for end-user total cost of ownership. We continue to set the industry benchmark for PEM fuel cell performance in our target markets. The accumulated distance driven by FCEVs powered by our technology underlines Ballard’s customer focus and commitment to reliable service and high uptime. We achieve this industry milestone at a time when we are seeing growing customer interest in the adoption of hydrogen fuel cells in our key mobility verticals of bus, truck, rail, and marine, as well as off-highway and stationary power applications.”

Randy McEwen, Ballard chief

First quarter has little predictive power

Order volume ended up good: 137.7 million USD, a doubling from the same period the previous year. Turnover for the quarter reached 13.3 million USD, which was below analysts’ expectations. Good things can be expected from the second half of the year. McEwen sees a very busy second half of 2023 and an excellent year 2024.

In the bus sector came three new OEMs, so companies that build buses and are relying on the FC module and knowhow from Ballard. Van Hool and Solaris have long been satisfied customers. Over 500 FC buses are currently set to be ordered in Europe, a large share of which equipped with Ballard. Meanwhile, 1,500 transit buses are in the tendering process – in Europe. For me, however, this is just an indicator of a development that will really pick up speed in the coming years.

The same pertains to commercial vehicles, where gradually the major truck manufacturers are turning, in addition to battery-electric solutions, to hydrogen. About this, McEwen said, “To be clear, the truck market is in the very early phases of fuel cell market adoption.” Here, Ballard is supplying stacks to various OEMs such as Quantron, and further customers may follow. In the area of trains, things are also slowly getting underway, which the rising orders of Ballard partners Stadler and Siemens Mobility show. Their customers are increasingly opting for a mix of battery-electric and hydrogen-powered trains. Ballard is also well positioned here – often in competition with Cummins or Alstom.

First Mode has raised its order for FC modules for heavy mining trucks from 30 to 35, and it’ll be likely 400 units in total for its partner Anglo American. For Canadian Pacific Rail (CP), locomotives have already been equipped with FC modules. Larger orders will probably come, and can be expected in the second half of the year.

In Norway, meanwhile, the ship MF Hydra was put into operation. Liquid hydrogen is turned into energy with the help of Ballard’s 200-kW module. The ferry for 300 people can travel for up to 21 days with it.

Everything out of pocket

The capital invest in the amount of 37.5 million USD in the first quarter mainly went into increased spending on R&D and product development – with over 860 million USD in the bank, not an issue. Interesting is an analyst’s question of why Ballard wants to allow new authorized capital to be given (so the possibility of issuing further shares), since it has sufficient liquidity at its disposal. This here is only about an extension of an expiring program or entitlement to issue further shares, so the tenor. They will also not make this a custom, was the answer.

I would interpret it differently: Ballard could quickly issue further shares if a takeover (acquisition) of a strategically interesting company presents itself, and quickly generate own capital through these shares or their equivalent, without having to dig into the high cash cushion. Everything has two sides.

Summary

Ballard may seem boring and is a big disappointment in terms of share price. The company has a very good standing, however, and is establishing and expanding its international presence, and is positioning itself so that it can in the future make and sell large numbers of stacks and modules for a variety of FC markets and thus earn money. As a partner of various OEMs, Ballard can Provide FC expertise and knowhow to a number of companies. These OEMs do not need to research and develop in this direction themselves: They buy turnkey products from Ballard and enter in competition with companies such as Toyota and leading truck manufacturers.

The China card would open up all possibilities should the country agree to a comprehensive H2 program, as Ballard would then be a big winner. Besides China, Ballard should also put its focus into India, which has a strong interest in hydrogen (see report on p. 58). Ballard equipped the first H2 train to run there. Thinking about the JV of Cummins and Tata Motors, Ballard could enter a similar venture with Ashok Leyland or Reliance. But that is only my personal view. Whoever sees Ballard in the medium or long term should use the severely depressed share prices for new and further buys.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Written by Author Sven Jösting, June 9th, 2023

0 Comments

Trackbacks/Pingbacks