by Monika Roessiger | Apr 16, 2024 | Energy storage, Fuel cells, Germany, hydrogen development, international, News

Optimism at the H2 Forum in Berlin

A good 450 participants gathered at the specialist conference H2 Forum in Berlin February 19 and 20 to discuss innovative H2 technologies, strategies for the market ramp-up and the necessary regulatory framework conditions. A further 1,000 participants were connected online, even despite the considerable time difference in countries such as India and the USA.

The event was opened via a video by Kadri Simson, EU Commissioner for Energy. The two-day program was held under the motto “Empowering the future of hydrogen,” where this year’s focus was on the production of the green gas by electrolysis and its transport in Germany and Europe. At the H2 Forum were, among others, representatives from E.on, Enapter, EWE, Linde, FNB Gas and the H2Global Foundation. They discussed the role of hydrogen in the defossilization of the economic systems. Philipp Steinberg of the German economy ministry outlined the various phases of the development of the hydrogen core grid in Germany.

Advertisements

Feelings of optimism and assurance were tangible throughout the high-ceilinged rooms of the Estrel Congress Center (ECC) as players from politics, industry and the energy sector talked about ambitious H2 projects at home and abroad. Inspiring as well was the approval by the EU Commission a few days before of a series of IPCEI projects, thus ending for some participating companies years of waiting. Additionally, the carbon contracts for difference and the auctions of the European Hydrogen Bank are giving hope to business representatives.

Spain: Megawatt-electrolysis in practice

For example, Özlem Tosun, project manager for green hydrogen at Iberdrola Deutschland, reported on the experience with a 20‑MW electrolysis plant, making it currently the largest in Europe. “I hope it doesn’t stay that way,” she added, in view of the necessary market ramp-up for green hydrogen. The Spanish energy corporation, known in the country primarily as an operator of wind farms in the Baltic Sea, started operation of the plant in Puertollano, May 2022 in the presence of the King of Spain. The city with nearly 50,000 inhabitants is located about 250 kilometers south of Madrid. The electricity for the hydrogen production comes from a 100‑MW photovoltaic park a few kilometers away and flows via an underground cable into the production hall, in which 16 electrolyzers of 1.25 MW each perform their work. These produce annually up to 3,000 tonnes of green hydrogen, which is temporarily stored in tower-high pressure tanks at 60 bar. The electrolysis plant is located next to the fertilizer factory of Fertiberia and currently covers ten percent of their hydrogen requirement, which according to Iberdrola saves 48,000 metric tons of CO2.

“But this is just the beginning,” stressed Tosun. “In the coming years, Iberdrola wants to increase the production more than tenfold – to 40,000 tonnes by 2027.” The demand is there, since otherwise Fertiberia is using for its ammonia synthesis gray hydrogen obtained from natural gas. That no comparable plant for the production of green hydrogen on an industrial scale is yet in operation is also due to the fact that the whole thing is not as simple as it sounds in the big plans and letters of intent. “It didn’t go smoothly from the start,” admitted Özlem Tosun. “On the contrary – we had a lot of problems. But we also learned a lot and were able to improve a lot as a result. Not only technically, but also economically.” One of the most important points was to optimize the efficiency of electricity use. Contributing to this was that the performance and efficiency of the electrolyzers were able to be increased further and further.

Overall, the practical experience in Puertollano was important “to be able to scale the system.” As far as the large-scale production of climate-neutral energy sources is concerned, the multinational energy company not only sees itself as a pioneer, but is also optimistic about the future. Because Spain first wants to become independent of fossil fuel imports and then be able to export renewable energies. So it’s no wonder that Germany is for Iberdrola “a key market,” as Tosun says, “especially for green hydrogen.”

Lack of regulation as a stumbling block

How the development of a German and European hydrogen industry can be accelerated was one of many other topics discussed at the conference. It is important to break down barriers – for example lack of regulation and infrastructure – it was said in a panel discussion. Such hurdles, the speakers agreed, were in addition to the high costs for H2 production, like before, the crucial reasons why not a small number of companies, despite the positive feasibility studies, are still waiting with the final investment decision. The following figures show just how wide the gap is between aspiration and reality when it comes to the gas of the future: In recent years, the German government has raised the target for domestic production of green hydrogen from the original three gigawatts to ten gigawatts, yet so far not more than 62 MW of generation capacity has been installed. That there is a long way to go, but which can go faster, further practical examples have shown.

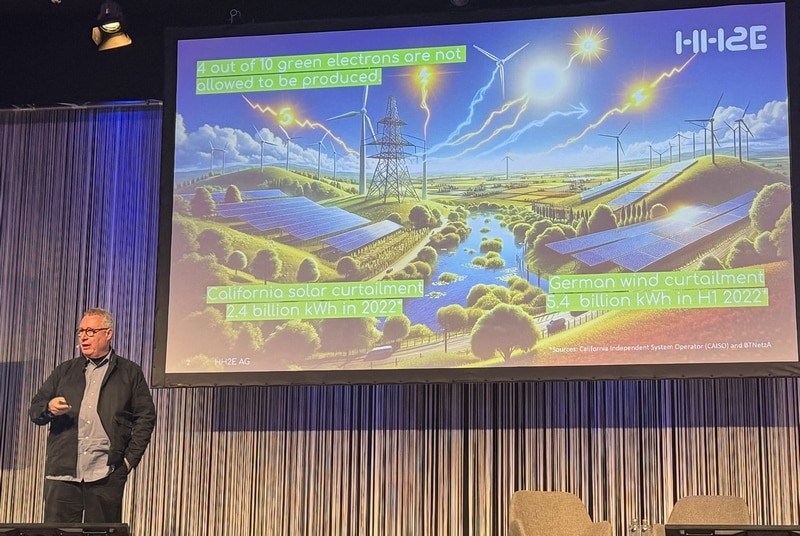

“Never waste a green electron again!”

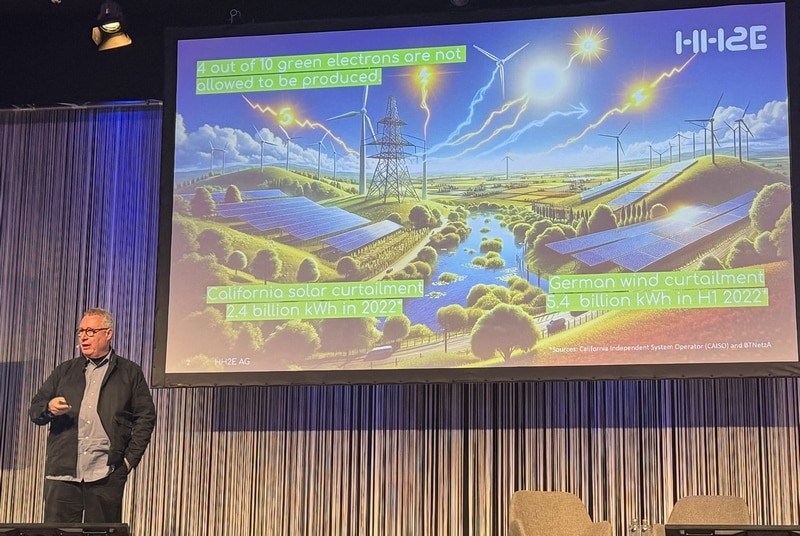

“Did you know that with the wind power that was curtailed in the first half of 2022 alone 1.5 million households in Europe could have been supplied with electricity for a year?“ (The figure refers to average households with a consumption of 3,500 kWh per year.) That was one of several questions with which Alexander Voigt, managing director of HH2E, began his speech. “What could we do with all the green electrons that are not being generated only because the power grid cannot absorb them?” His answer, of course: Hydrogen! But also high-performance battery storage, to be able to offer energy for stabilization of the power grid. That’s how he explained the business model of the planned HH2E factory in Lubmin, Germany. It will use surplus electricity to “reliably and cost-effectively produce green hydrogen.” In addition will come CO2-free heating and, if required, the conversion of the “green molecules” back into electricity.

Alexander Voigt, CEO von HH2E, nutzt künftig Überschussstrom in Lubmin (Foto: Monika Rößiger), Source: Monika Rößiger

With this, the plant could contribute to the decarbonization of industry in Germany and, at the same time, support the energy supply. The final investment decision will be made shortly, according to Voigt, and then the way would be clear for the start of construction. In the year 2026, according to the plan, energy generation is to start: around 100 megawatts of total capacity in the first expansion stage, divided between a 56‑MW electrolyzer and a 40‑MW battery storage system. The electricity for electrolysis is coming from offshore wind farms in the Baltic Sea. Initially, the operators expect to produce around 7,200 tonnes of green hydrogen per year. The production capacity of the plant is scalable up to one gigawatt. Lubmin, once a transshipment point for Russian natural gas, will then become a center for green hydrogen. This can be fed into the existing natural gas grid that extends from the northeast of Germany to the southwest near Stuttgart.

In total, more than 40 companies from the entire H2 value chain presented their solutions and products in the high glass hall next to the conference hall in the Estrel Congress Center. The organizational framework of the H2 Forum was right: There was time to connect during the coffee breaks, lunch and supper. Lively discussions took place at all the tables and stands. That more politicians were present this time than at previous events was, according to Laura Pawlik, Sales Manager of the organizer IPM, particularly emphasized in the feedback from the participants. And also that the representatives from politics and administration were definitely open to further funding.

The date for the next conference has already been set: March 4 and 5, 2025, again in the ECC in Berlin. Focal points will be in addition to politics also the regulatory progress in Germany and Europe.

by Sven Jösting | Apr 16, 2024 | Germany

The major international gas companies such as Linde, Air Liquide and Air Products have always been active in the field of hydrogen, but so far with the industrially demanded “gray” hydrogen based on natural gas. In addition, the hydrogen molecule is essential for many derivatives and chemical compounds. The trend is now increasingly moving towards green, so regeneratively produced, hydrogen. And also and directly here the three companies mentioned are positioning themselves, by establishing very large electrolysis production capacities worldwide and entering into strategic alliances in countries that are ideal for it, because the conditions there (high solar radiation, wind power and hydropower, and water, especially seawater) could not be more perfect.

The main focus there is on blue hydrogen, which can be produced cost-effectively by reforming natural gas and which, through storage (CCS & CCUS) but also through industrial use of carbon, has a lower carbon footprint. On top of this is the very weighty argument that they can additionally benefit from various subsidy programs, be it in the EU or in the USA with the Inflation Reduction Act.

Advertisements

On the stock market, some of these bright prospects have already been reflected in the share price performance and valuation, but there are differences that could be made use of, since Air Products & Chemicals, in contrast to Air Liquide and Linde, has not yet really participated in the run. Hence the recommendation to bet on the latecomer:

Company Valuation Turnover PE ratio 24 Dividend yield

Linde 185 billion USD 36 billion USD 37 0.9 percent

Air Liquide 99 billion USD 33 billion USD 33 1.8 percent

Air Products 52 billion USD 12,7 billion USD 24 3 percent

Air Products & Chemicals

The company is relying heavily on hydrogen and ammonia, to serve long-haul traffic with the latter. In Hamburg, it has joined forces with the globally active petroleum and chemical trading company Mabanaft (subsidiary of the Marquardt & Bahls Group, which operates a global storage facility for all types of petroleum products, including kerosene for aircraft, and its own network of refueling stations) and is planning an ammonia processing plant (cracking) with an investment of over one billion euros in the port Hamburger Hafen. But first it’ll entail blue hydrogen, which is to find its way to Europe, and from countries such as Saudi Arabia, where they are working together on the project Neom Green Hydrogen and where Air Products & Chemicals was able to land an order volume of 6.7 billion USD.

A look at the charts shows that Air Products & Chemicals is not far from last year’s lows, whereas Linde and Air Liquide have reached new highs. As a group, these shares will continue on their path, but, as a latecomer, the share of Air Products & Chemicals appears the most favorably valued. The quarterly dividend was recently increased to 1.77 USD per share. First price target: 300 USD.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: Sven Jösting, written March 15th, 2024

by Hydrogeit | Apr 15, 2024 | Energy storage, Germany, Policy, worldwide

Background to the Bonhoff/BMDV split

Things had quietened down on the Bonhoff front. But then new information surfaced in February 2024 which prompted German transportation minister Volker Wissing to take action. On Feb. 15, he released Klaus Bonhoff, head of the policy issues department, from his duties with immediate effect and also moved a divisional head. The reason behind the decision lies in a discrepancy uncovered during an internal review undertaken by the transportation ministry, also known as the BMDV. The affair gained added force when German news magazine Der Spiegel reported on Feb. 20 that Wissing had stopped “completely the approval of hydrogen funding.” Yet in reality funding is not being axed. The ministry is merely carrying out reassessments that could lead to a delay.

Advertisements

But one thing at a time. In this article we’ll attempt to shed light on who did what to whom as well as how and when it all happened.

It started back in summer 2023 when German business paper Handelsblatt published an article about a questionable friends and lobbying network. The suspicion of nepotism that was raised on various sides was based on the alleged existence of an overly cozy network of contacts linking a number of different political and industry figures. Bonhoff was reproached for his reported friendship with Werner Diwald, chairman of the German hydrogen association, and its president, Oliver Weinmann, both of whom he allegedly joined on a ski trip. What’s more, it was claimed that Bonhoff helped the German hydrogen association, abbreviated to DWV, to gain funding in 2021.

Stefan Schnorr, state secretary at the German transportation ministry, was tasked with clarifying the facts and, according to Der Spiegel, gave the all-clear a few weeks later, stating there was “No trace of favoritism.” At the same time, Bonhoff received broad support, particularly from the hydrogen sector.

Everything bubbled up again in early 2024 when Der Spiegel quoted parts of an email exchange between Bonhoff and Diwald (see freedom of information website www.fragdenstaat.de). This apparently substantiated a high degree of closeness and familiarity between the two men.

Inconsistencies and contradictions

In fact, what the disclosed emails show is that certain wishes and views regarding funding measures had been articulated on the part of the DWV. For example, Werner Diwald wrote in September 2021: “In view of the upcoming elections it would certainly be good for grant approval to be given before the end of this legislative period.” (Der Spiegel, Feb. 6, 2024)

This prompted Bonhoff to forward the email to the appropriate specialist department at the transportation ministry where he inquired after the state of affairs, according to the statement he gave to H2-international. As Der Spiegel and Tagesspiegel Background, another German publication, both reported, he also “orally supported” the project. However, given this expression of support was previously denied, this admission could now cause no end of trouble for the ministry.

LobbyControl then took it as proof that favoritism was indeed at play. On Feb. 16, 2024, the online platform stated that days before the ministry had conceded there were “inconsistencies and contradictions” in the allocation of funding and that is why minister Wissing relieved department head Klaus Bonhoff from his duties.

“The necessary relationship of trust between the minister and the head of department no longer exists.”

Stefan Schnorr, state secretary at the German transportation ministry, in the Frankfurter Allgemeine Zeitung (FAZ)

Furthermore, LobbyControl criticizes what it sees as the inadequacy of compliance rules at the transportation ministry and Bonhoff’s lack of a clear-cut separation between his personal and official contacts when it comes to grant allocation.

Overly cozy network?

Klaus Bonhoff, who is also known as “Mister Hydrogen” due to his extensive experience in leadership roles in the H2 and fuel cell sector, had previously worked for many years on fuel cell cars at Daimler before becoming managing director of Germany’s National Organisation Hydrogen and Fuel Cell Technology, or NOW, in 2008 (see HZwei, April 2011 & H2-international, October 2019). From there he transferred to his post at the German transportation ministry. His successor at NOW since May 2020 has been Kurt-Christoph von Knobelsdorff (see H2-international, February 2021).

Thanks to his considerable expertise, he was a popular and long-standing contributor at numerous industry events since he was well known as an adept public speaker with a skill for highly diplomatic and precise wording. It’s understandable that the DWV in particular wanted to get close to him given that the association comprises many major German industrial corporations from the H2 community and Bonhoff, in his role as NOW spokesman, was the main point of contact for funding applications in the hydrogen sector. However, the responsibility for awarding funds, both then and now, lies with the project management agency Jülich (PtJ).

The DWV’s role

Over the years, the DWV has developed – especially under the leadership of Werner Diwald – from a highly committed body of motivated idealists to an industrial lobbying group. Because of this change, some of the original members who prefer an idealistic approach have turned their back on the association in the past few years. Some of them have urged repeatedly for less dependency on industry and greater levels of transparency. Most recently, Johannes Töpler, who was a long-serving chairman of the DWV, resigned from his post as the DWV’s education officer at the turn of the year. Among the reasons for his resignation was that he no longer thought education and training, a crucial area in his view, was receiving the appropriate attention and appreciation it deserved within the work of the association.

In terms of legal form, the DWV is officially a registered association. Over the years, Diwald has worked to set up various expert commissions to which participating companies pay high-level contributions. This enables the DWV to represent their interests, including on the political stage in Berlin and Brussels. As such, political evenings and business talks are organized on a regular basis where political and industry representatives can meet, as commonly occurs in associations nowadays. One of these expert commissions, HyMobility, was awarded millions of euros in funding in 2021 via the PtJ, i.e., from the transportation ministry’s budget, something which Bonhoff is now being reproached for.

The ministry confirmed to H2-international: “The HyMobility innovation cluster is supported by the Federal Ministry of Transport and Digital Infrastructure as part of the national hydrogen and fuel cell innovation program. The grant is up to €1,438,600. The calculation is based on actual expenditure up to the maximum grant level. […] The HyMobility cluster is financed through grants, contributions for cluster membership, and a proportion of the membership contributions of the DWV. […] The funding project facilitates cluster management, cluster coordination, the support and guidance of the expert commission’s work as well as the preparation of findings from the expert commission and from the expert committees and the provision of recommended courses of action to meet further development needs. In addition, the funding covers the venues for cluster meetings, the creation of studies and analyses as well as technical and legal reports. […] The funding is allocated for specific purposes.”

HyMobility’s aims, according to its project outline, include: “Involvement in the formulation of relevant policy and legal conditions at a national and European level for the market preparation and introduction of low-carbon mobility based on renewable hydrogen. […] the creation and strengthening of understanding for and trust in innovative and low-emission vehicle technology based on renewable hydrogen within transport and national and European politics.”

In connection with this, the DWV confirmed to H2-international that the goals of the expert commissions are to “attract attention for the particular topic, raise awareness, bring together stakeholders from the relevant areas and sectors, prepare joint positions and recommend courses of action to policymakers.

LobbyControl makes the following criticism in relation to this: “It is unusual and questionable that an industrial lobbying association such as the DWV should receive a state subsidy for work that it would carry out regardless: maintaining networks and lobbying.”

“The HyMobility project is supported by the Federal Ministry of Transport and Digital Infrastructure through a total of EUR 1.8 million in funding as part of the national hydrogen and fuel cell innovation program. The funding guidelines are coordinated by NOW GmbH and executed by the project management agency Jülich (PtJ).”

https://dwv-hymobility.de/organisation/

Bonhoff told H2-international: “HyMobility is funded in the same way that the environment ministry funds the HySteel project which was approved prior to HyMobility.” Tagesspiegel Background reported on this very subject on Feb. 7, 2024: “The ministry [German environment ministry; editor’s note] is satisfied with the project. ‘Such networking is effective and successful, is conducive to the sharing of best practice and the establishment of horizontal and vertical partnerships in research, testing and production.’”

Among the 22 members of HyMobility are NOW and H2 Mobility Deutschland. H2 Mobility is a consortium of various automotive, industrial gas and petroleum companies plus an investment fund focused on the construction of hydrogen refueling stations in Germany. Practically every station that is built and managed by this Berlin-based company is subsidized to the tune of nearly 50 percent from European funds or the funds of German central or regional government. One of the three directors is Lorenz Jung (see H2-international, October 2023), who took up the role in April 2023. According to information from LobbyControl, he is the son-in-law of Oliver Weinmann. Jung, whose wife (Weinmann’s daughter) works at NOW in the communications department, has been a manager at the company virtually since its inception.

The roles of Weinmann and Diwald

Weinmann is a founder and board member of what was then the German hydrogen and fuel cell association (see HZwei, October 2010). Born in Hamburg, he had initially worked for city’s electricity company (Hamburgische Electricitäts-Werke or HEW) which was taken over by Swedish corporation Vattenfall Europe when it became the majority shareholder in 2001. Weinmann held the position of managing director at Vattenfall Europe Innovation GmbH from 2010 to July 2023, followed by head of innovation management at Vattenfall Europe AG. From 2020 onward he has also worked in a voluntary capacity as the president of the DWV. In addition, he is chairman of the NOW advisory council, vice chairman of the hydrogen body Wasserstoffgesellschaft Hamburg and holds or has held – according to his own HyAdvice website through which he offers freelance consulting services on matters including funding – further leadership positions at various organizations, among them Hydrogen Europe and the Energy Storage Systems Association or BVES.

Oliver Weinmann at a parliamentary evening in Berlin in 2022

Similar to the way Weinmann operates with his HyAdvice consulting business, Diwald offers his services through PtXSolutions, formerly known as ENCON.Europe. The company is the vehicle through which the DWV chairman provides consultation as a sideline to institutions such as the DWV, Encon Energy EOOD (ENCON subsidiary), Enertrag (former employer), NOW, Performing Energy (DWV think tank) and Vattenfall Europe Innovation. Originally, ENCON.Europe had undertaken some work for the DWV (see H2-international, October 2020). According to a statement by Diwald, ENCON.Europe at the time played a considerable part in increasing the visibility of the DWV without itself appearing in the limelight. He says the company positioned the DWV and the Performing Energy expert commission exclusively as brands in the political sphere and negotiated in the interests of the association. From 2017, the company’s staff included Dennitsa Nozharova, Werner Diwald’s wife, who at the same time also worked for the DWV and is also involved in Encon Energy EOOD.

Fig. 3: Werner Diwald has been DWV chairman since 2014

Performing Energy was the first expert commission that the DWV initiated in 2015 on the back of Warner Diwald’s efforts; Diwald himself had previously created this alliance for wind-based hydrogen systems in 2011 and taken up the position of its speaker (see HZwei, January 2012). Participating organizations include Enertrag and Vattenfall as well as other companies which are also involved in other groups within the network.

Werner Diwald addressed the situation regarding some association members by stating in an email seen by H2-international: “The media’s assumptions about a possible breach by the DWV of compliance rules in relation to the funding application made by the HyMobility innovation cluster are unfounded. […] There was no improper influence exerted by the DWV. The DWV does not accept funding to carry out its statutory activities. […] By virtue of the funding of the HyMobility innovation cluster by the BMDV, the DWV has clearly not placed itself in a position of dependence on the government.”

Furthermore, the DWV has yet to issue a public statement, with the exception of a communication disseminated to association members (as seen by H2-international). The message sent, at the end of February 2024, outlined that “initial measures” have been “immediately introduced” that “go beyond the content of the DWV’s ‘Code of Compliance’ in order to make a comprehensive review of the situation.” It goes on to say that the DWV executive committee has “immediately commissioned a comprehensive review of the DWV’s compliance rules and of external and internal processes and procedures in the context of funding applications and funding allocations.” This is to be carried out by Berlin law office Redeker Sellner Dahs.

H2 funding frozen?

The saga then reached its peak after Der Spiegel reported that the transportation minister had allegedly frozen all funding for H2 projects. According to the article, no more funding is to be approved for the sector for the time being and no further agreements are to be concluded. Even amendment notices will require approval at state secretary level, it said.

However, a press spokeswoman for the ministry clarified the issue at a press conference on Feb. 21, 2024, by stating that the ministry had “not stopped hydrogen funding per se” but is carrying out more thorough assessments of funding applications. These “are currently focused on the approvals procedure for the DWV’s HyMobility funding project.” Should relevant evidence be produced during the investigation, further funding projects will also be examined more closely if necessary.

The reason for this tightened approach seems to be the Brunner affair. It relates, among other things, to the email exchange that took place via a personal GMX account through which Klaus Bonhoff and others communicated with Bavarian businessman Tobias Brunner, managing director of Cryomotive and Hynergy and a key figure in establishing the hydrogen technology application center WTAZ in Pfeffenhausen. LobbyControl disapproves of this “use of a private email account for official communication” since it meant this email exchange was not known to the ministry’s internal review department and therefore could not be taken into consideration in its final report. In all, there are 14 gigabytes of data that require sifting, which explains why there is a delay in the processing of further approvals.

Author: Sven Geitmann

by Sven Jösting | Apr 11, 2024 | Germany

Bloom Energy is planning a cooperation with Shell to use its SOEC technology for the large-scale production of hydrogen. Bloom points out that they’ve already performed very successful series of tests with the Ames Research Center of NASA in Mountain View: 2.4 metric tons of H2 per day were able to be produced there – best performance in terms of energy input in relation to hydrogen output and thus far superior to PEM and alkaline electrolysis.

Bloom Energy reports for the fourth quarter of 2023 a turnover of 357 million USD, although they expected 450 to 500 million USD. That makes it 1.33 billion USD for the entire year 2023, when it was to be 1.4 to 1.5 billion USD. The non-GAAP profit margin is expected to be 28 percent in 2024. However: 160 million USD of the missing turnover is on account of a billion-dollar framework agreement with the South Korean SK Group, which is also the largest single shareholder in Bloom. Annual targets for projects and the associated revenues (orders) were defined here, which came out 160 million USD less than expected in year 2023.

Advertisements

These revenues will only be realized with a delay, namely starting 2024. Now, there is a new contract that runs on a quarterly basis and therefore – according to the chief financial officer – is much more calculable, as minimum sales per quarter have been defined. That the stock market is disappointed by the development in 2023 is obvious. On top of that, the growth in the first half of year 2024 will come out lower than expected, until things really get going again in the second half of the year. For 2024, a turnover target of 1.4 to 1.6 billion USD has now been set – it originally should have been over 1.8 billion USD. But – and this is positive – the non-GAAP profit is expected to lie between 75 and 100 million USD this year. Negative is that CFO Greg Cameron is leaving the company for personal reasons. This is truly a cocktail of “short-term” negative news, which may soon be forgotten in view of the prospects.

“Our full expectation for Bloom is that it will leave 2024 with a bunch of commercial momentum, both in winning deals as well as delivering on systems.”

Leaving CFO Greg Cameron

There is an orders on hand of 12 billion USD (backlog: 3 billion USD in hardware and 9 billion USD in long-term service contracts). The company with its Energy Servers is very well positioned and has a leading position in high-temperature electrolyzers, which will come onto the market in 2025 – initially with a capacity of 2 GW per year and a strong sales growth, likewise starting 2025.

Test series, including in the Idaho National Lab, were extremely positive, it was stated at the press conference on company figures. Nearly 750 million USD cash in the bank is a healthy self-financing cushion. Not until August 2025 must 250 million USD in debt be cleared. With higher share prices, it should not be a problem then to issue new shares and replace foreign capital with own capital. More important is the look at the company’s profit: That came out very well, with a plus of 27.4 million USD as non-GAAP profit in the fourth quarter 2023.

The goal is clearly defined: In 2024, the profit margin is to be increased through cost management, higher margins in the service area and price discipline. Material costs are set to fall significantly this year to avoid supply chain problems. The production facility in Fremont, California has a capacity of 700 MW per year, which can easily be doubled. In addition, new business models (energy on demand 24/7 and heat & power) and many innovations will characterize the new fiscal year. Clear is that AI as well as the increasing electrification will not allow, like before, an energy demand of around AI and increasing electrification will not allow energy demand to rise by 0.5 percent per year, like before, but by a factor of ten, according to CEO KR Sridhar. The missing grid expansion will therefore promote island solutions, like what Bloom offers.

In the USA alone, 90,000 miles of high-voltage power lines would have to be built to transport the required energy. In 2022, it was just 700 miles in the USA. The risk of power outages and a lack of energy availability thus increases considerably. This applies not only to the USA, but also to many industrialized nations. Whereas in the past it was often about the price of energy, now it is about the availability and security of supply, since a loss of power can lead to enormous damages.

All this plays into the hands of Bloom Energy, said Sridhar. The demand for stand-alone solutions, for example for data centers, is enormous. Talks are being held with all important and leading companies in the industry. The talk is now always of gigawatts and no long of megawatts. Many an AI company has already received a message from its energy or electricity supplier that the desired amount of energy cannot be produced. In addition to these so-termed greenfield data centers, which basically form from scratch, are coming newly planned microchip production facilities, charging stations for commercial vehicles and logistics centers.

Here, Bloom is counting on its rapid project implementation (“rapid deployment capability”) and flexibility. Numerous orders are expected here by 2024. Furthermore, waste heat from data centers via net-zero stream and net-zero cooling will be used for process heat and be a CO2-free waste product. With these solutions, Bloom can support energy suppliers by providing energy flexibly, cleanly (50 percent CO2 reduction), 50 percent more cheaply and five times faster than ramping up gas turbines. Thus Bloom is also becoming a partner to energy suppliers.

Dr. Ravi Prasher was able to be gained as the new chief technical officer (CTO). He is, among other things, a member of the prestigious association National Academy of Engineering. He is to turn business opportunities into concrete orders. He comes, like so many board members at Bloom, from General Electric (GE), where he worked for 20 years. He sees the high-temperature fuel cells of Bloom as a game changer, with which no SOX, no NOX and no CO2 emissions are produced during the combustion of hydrogen. Bloom could, according to Prasher, solve all the problems that many industries have with their energy use. In addition, Bloom’s electrolysis technology is the most efficient on the market.

General remarks

To various special analysts of notable banks Bloom has pointed out that some projects are delayed, as potential customers often need more time than planned to develop the spaces for data centers (approval procedure) or to clarify financing issues. This does not directly have anything to do with Bloom, but must be taken into account in the schedule. In addition, more attention will be paid to customer payment management. Accordingly, the second half of the year will be significantly more robust than the first half, it was said: 60 versus 40 percent in the second half of the year.

Potential not yet priced in

Starting 2025, the new market for high-temperature electrolyzers will generate further growth potential. Among other things, this technology will be used in four of the seven planned Energy Hubs of the Biden administration. As the outlooks are good and Bloom offers the right technologies for safe, clean and available decentralized energy solutions, the stock market will not be able to avoid anticipating all this in the share price. This will also result in a number of major orders this year, which, however, will only be included in the balance sheet from 2025 onwards due to the timing of implementation. For analysts, this is then the basis for upgrading the share – from “hold” to “buy” or “strong buy.” The current price weakness will soon pass and will be forgotten if Bloom – and this is expected – can book corresponding orders this year. The potential of shares from the electrolyzer sector will come on top of this.

Strongly depressed prices are clear buy prices

With a stock market valuation of only 2 billion USD an undervaluing has been reached that could even make Bloom a candidate for takeover. GE or Siemens Energy should take a close look at the company, as the SK Group has done: participation and joint project development. It would be better if the stock market were to correctly assess the prospects and quickly forget the current undervaluation. Year 2024 will be a transition year with weaker growth, but this will be followed by many years of very strong growth, which can be inferred from many of the statements made at the press conference for the fourth quarter of 2023 and the year as a whole. Important is above all that Bloom is well on the way to becoming profitable. For 2024, the previous CFO was targeting a non-GAAP profit of 75 to 100 million USD.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: Sven Jösting, written March 15th, 2024

by Niels Hendrik Petersen | Mar 18, 2024 | Development, Energy storage, Europe, Germany

Interview with Thomas Korn, CEO of water stuff & sun

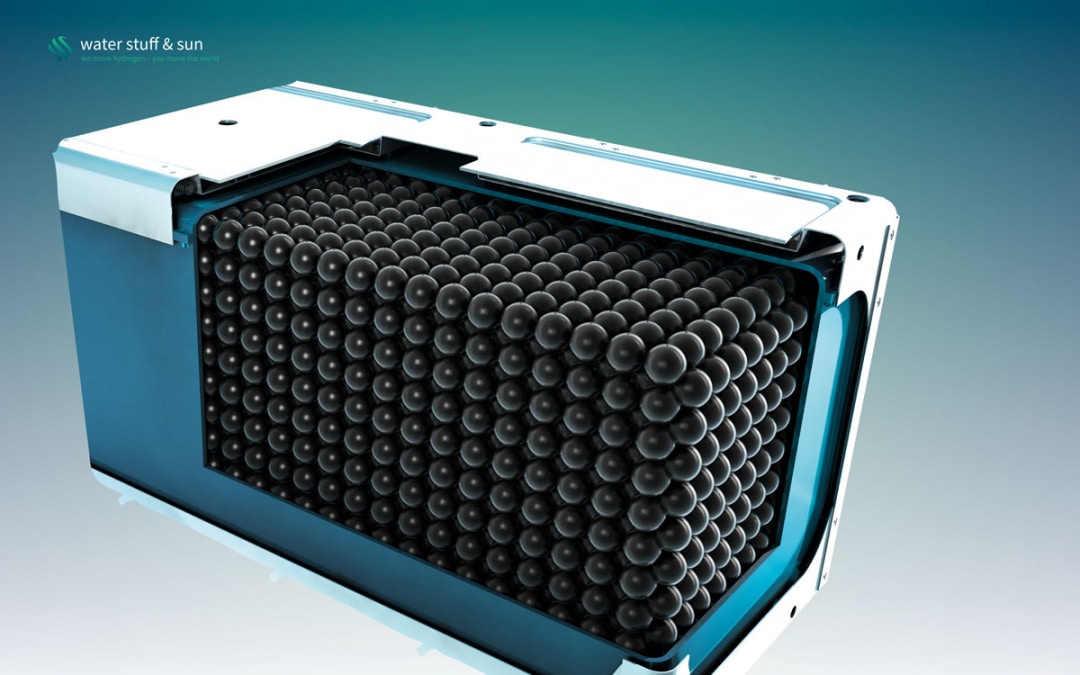

Startup company water stuff & sun has developed a novel technology that is designed to provide a safe and easy way to store hydrogen. The solution’s key component is its microvalve system. A pressure regulator controls the release of hydrogen progressively from 1,000 bar down to just a few bar. H2-international spoke to Thomas Korn, CEO of water stuff & sun, about how it works and the challenges encountered.

H2-international: Mr. Korn, the storage and refueling of hydrogen is a challenging issue. How do you solve that problem?

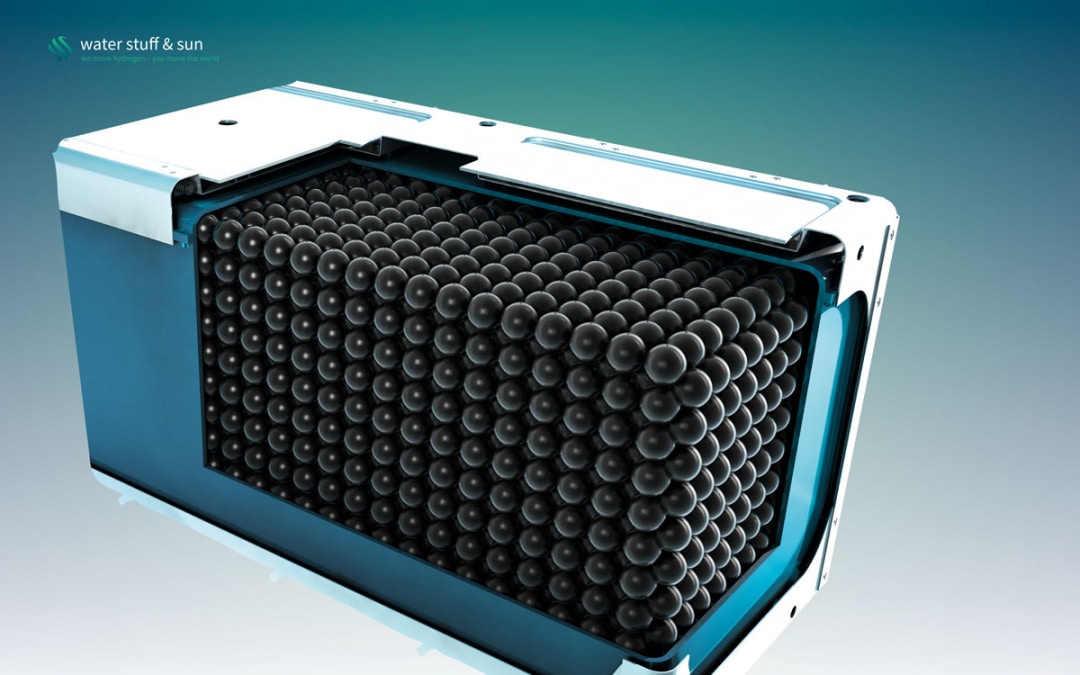

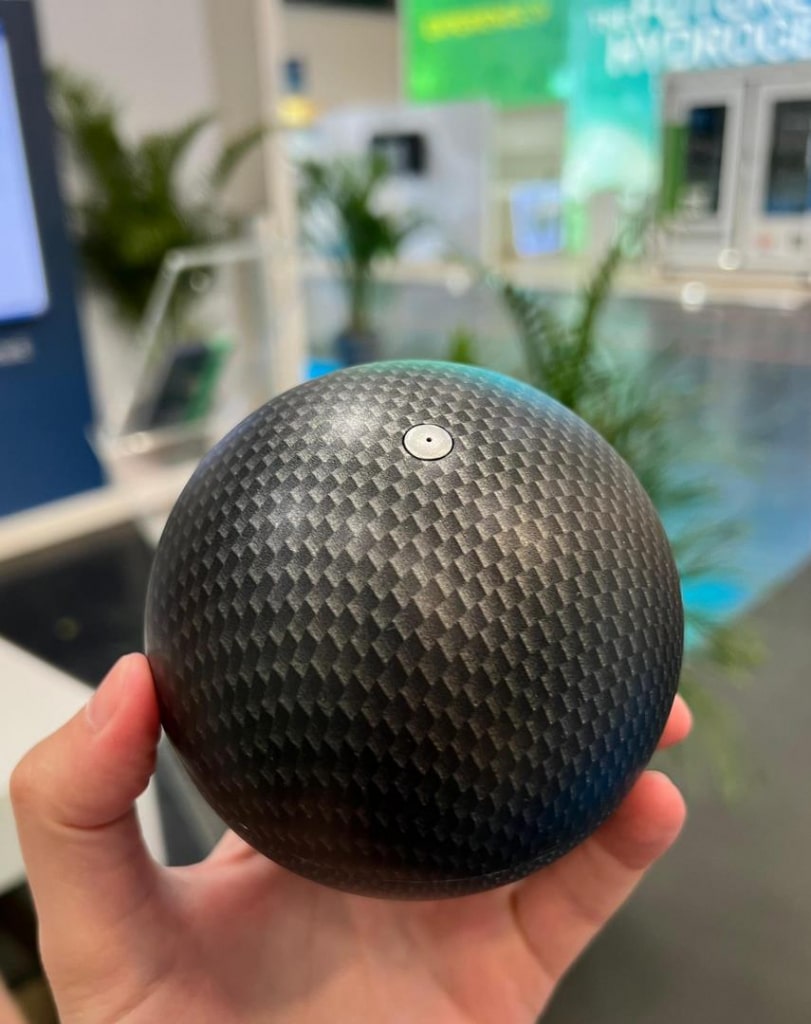

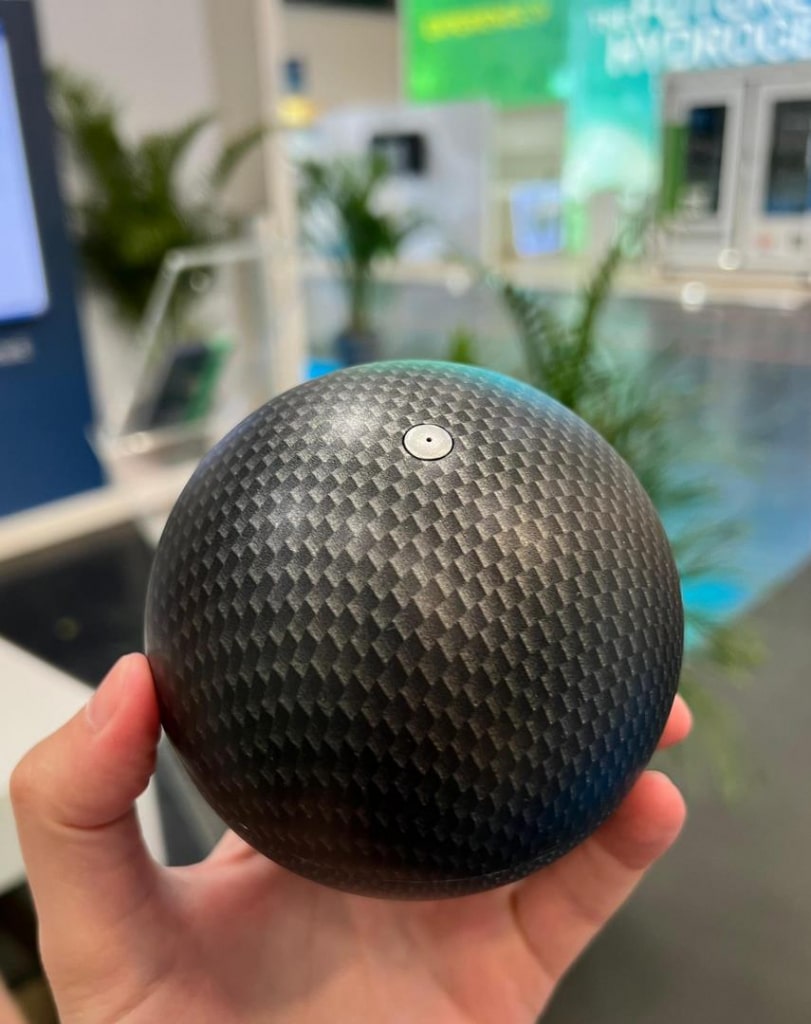

Korn: As it stands, the storage of hydrogen in conventional compressed gas tanks is complex and expensive. There is a trade-off between performance, safety and cost. We have a surprising solution to this: Instead of using a small number of large cylindrical tanks, our technology allows us to store the same amount of hydrogen in multiple spherical carbon-fiber vessels the size of a tennis ball. The silicon microvalve system, which is built into every pressurized ball, means that all the vessels act identically and in unison, just like a large tank. The expense involved in ensuring the safety of hydrogen stores can be significantly reduced if the energy is split into multiple small vessels. As a result, we save almost half the carbon fiber material compared with a standard pressurized tank. We call these ball-shaped high-pressure storage vessels Sfeers.

Advertisements

They allow hydrogen cells to be scaled as required and integrated into hydrogen batteries of any shape. Green hydrogen can thus be used in a variety of motive and stationary applications such as trucks, drones and airplanes. The next generation of these energy stores will be 95 percent lighter and up to 30 times cheaper than lithium ion batteries – while still carrying the same amount of energy.

Fig. 2: Doing the rounds: a Sfeer ball at the EES trade fair in Munich

How does the hydrogen battery work?

Hydrogen batteries are low-pressure hydrogen tanks containing Sfeers which are filled at up to 1,000 bar. The hydrogen battery enclosures are designed for low pressures and can therefore be perfectly adapted to the available installation spaces in a wide array of mobility products. When hydrogen is extracted, the pressure in the hydrogen battery enclosure decreases and activates the microvalve system in all the Sfeers once the pressure drops below a mechanically programmed ambient pressure range. These then release hydrogen, together providing the energy required for a hydrogen engine or a fuel cell.

The pressure in the hydrogen battery rises again above the pressure activation level that is set during the manufacture of the micromechanical components. Once the pressure level has been reached, all the microvalves close. The pressure in the battery stays constant or reduces further if the consumer withdraws more hydrogen. The activation pressure is set to the supply pressure of the consumers. The hydrogen battery can be thought of as a low-pressure tank, but with the capacity of a high-pressure tank.

The concept increases the safety level while at the same time reducing the amount of material used. Since their highly adaptable shape means they can make best possible use of the available space, hydrogen batteries outperform conventional pressurized tanks in terms of volumetric and gravimetric power density.

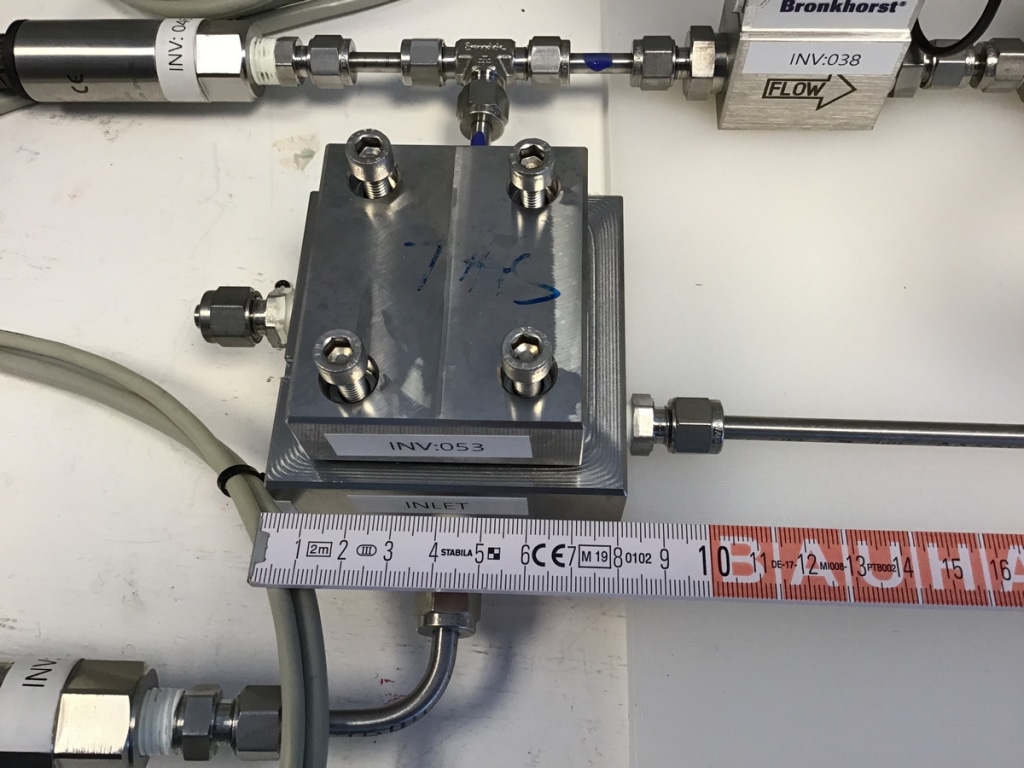

Microvalve technology has its origins in satellite technology. How is this technology produced?

Satellites have a gas propulsion system that secures their position within the communication window. Even in the early days, industrial developers started to use microsystem technology to regulate gases due to financial pressure to make ever smaller and lighter satellites. Our innovation centers on the development of micromechanical switching elements that don’t need electrical energy for their control; instead they are controlled passively by the ambient pressure. As in semiconductor engineering, highly industrialized manufacturing processes are used that can create thousands of identical parts on large silicon wafers. Valves, gas channels and the five-stage pressure regulator are produced and joined in four silicon layers. All chip components are built into a space measuring 4 x 4 x 2.5 millimeters (0.16 x 0.16 x 0.1 inches).

How did you come up with the idea of spherical high-pressure vessels?

The technology was invented by Prof. Lars Stenmark, who taught microsystem engineering in the Ångström Laboratory at Uppsala University and who had already applied earlier inventions to the aerospace industry. When he told me about his hydrogen storage invention, I was all for it. A physical hydrogen storage vessel that combines two existing technologies and resolves the trade-off between safety, cost and performance in hydrogen tanks – we couldn’t resist and founded the company water stuff & sun in January 2017.

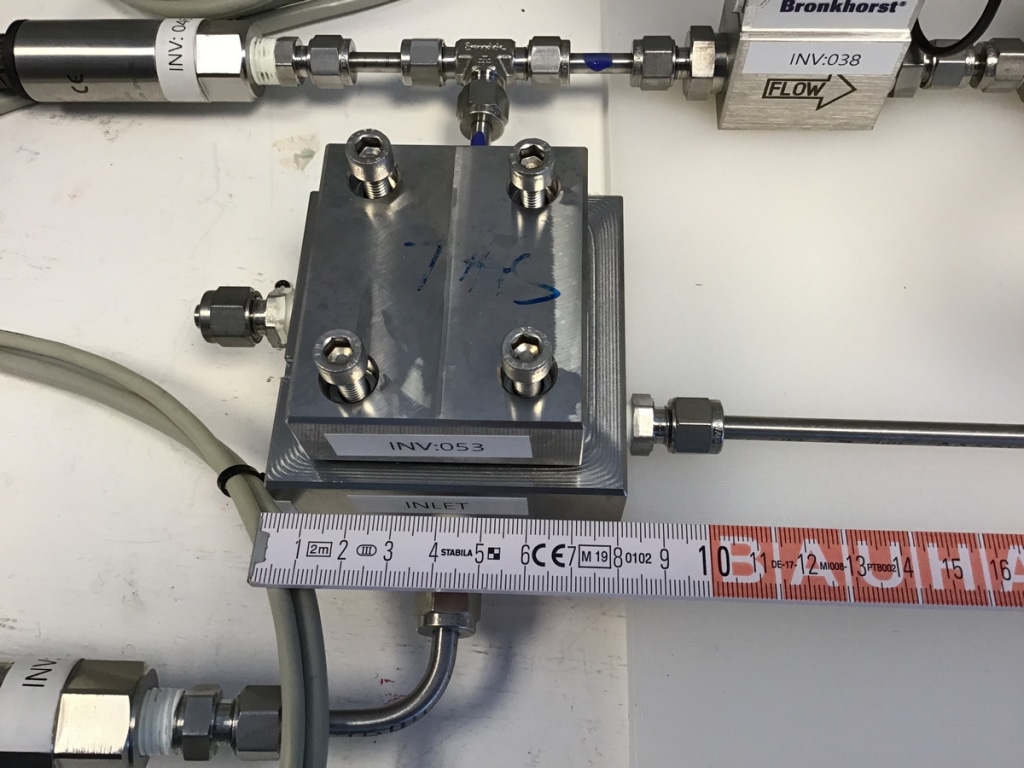

Fig. 3: A view of the lab shows the test setup for microchip evaluation

Is there already a prototype?

We have already produced and tested prototypes of switching valves and the key element of the valve system – the pressure regulator – in the clean room of the Ångström lab in Uppsala. We have also put a carbon fiber Sfeer prototype through a burst test and validated our simulation model with the results. At the moment we are building the first system prototype of a hydrogen battery with three Sfeer cells. The prototype and its use in a micromobility application will reach technology readiness level 5 in the first half of 2024. At that point we’ll start to develop hydrogen batteries for specific mobility products with several manufacturers and go on to industrialize them in the next stage. There is a great deal of interest from industry. For example, we have already submitted a joint funding project with an aircraft manufacturer and the German Aerospace Center. We are working with our partner Keyou to develop hydrogen batteries for converting and retrofitting trucks and buses. Additionally, we’ve managed to stimulate interest from a mining machinery manufacturer and a truck OEM.

Returning to the refueling process: Am I right that you are intending to swap the tanks?

Hydrogen batteries don’t need to be refueled in the vehicle; they are exchanged at swap stations or, in the case of small applications, they can also be exchanged by hand. That way, refueling can take place quickly and cost-effectively. The empty hydrogen batteries are refilled at central compressor stations and returned to the swap stations. The low operating pressure and the limited quantity of H2 in the hydrogen battery enclosure makes this ease of handling possible. In comparison with conventional high-pressure or liquid hydrogen refueling stations, the expense and complexity are significantly reduced, which in turn lowers the capital and operating costs and thereby also the hydrogen price. For heavy-duty vehicles, for instance, with hydrogen, several hundred liters of fuel energy equivalent need to be compressed, cooled and transferred. By simply swapping the hydrogen battery, the process can be completed in just a few minutes.

The financing required will be considerable. What are the next steps for your company?

The need for capital in a tech startup is always an issue – it’s a continuous process. We have just started a new financing round in which our existing investment partners, such as the investment arm of Kreissparkasse Esslingen-Nürtingen, or ES Kapital for short, the company Besto, run by the entrepreneurial Beyer and Stoll families, and machinery and tooling factory Nagel, have already registered an interest. I would refer to them as relatively down-to-earth, regional investors that have been involved from an early stage. The plan is to invest the new cash in the development of a prototype in the motive application area, as mentioned earlier, among other things. The raw materials for the production of semiconductor chips are all affordable. Carbon fiber and silicon are readily available on the market. That is an advantage in terms of further scaling. If everything goes according to plan, we will see the first of our batteries in a vehicle or aircraft by 2025.

Fig. 4: The H2 battery should be quick and easy to swap in and out of a truck

When and how will the market for your solution evolve?

The transformation of energy systems is well under way. Infrastructure for natural gas- and oil-based fuels is being replaced by hydrogen and liquid hydrogen derivatives such as ammonia, methanol or synthetic fuels. The competition for technology leadership and, ultimately, energy leadership began long ago. In China and the USA, many billions of euros are now being invested in hydrogen technologies and their infrastructure; we Europeans are attempting to counter this with the Green Deal. Hydrogen projects are sprouting up all over the place. As far as we are concerned, the market has already started; we’re currently concluding cooperation agreements with initial vehicle and machinery manufacturers.

Where will the first market be that manages to develop?

We need to take a multitrack approach and are therefore also looking at the USA and the Arab world. The country that achieves the lowest hydrogen prices by investing will attract a lot of companies and investment. In the EU and Germany I hope that the greenhouse gas quota gives us an instrument that is competitive.

You won a prize at the World CleanTech StartUPs Awards, otherwise known as WCSA 2023. What particularly impressed the judges?

Firstly, the award as a platform is a very interesting network in itself. Applications for WCSA 2023 were invited by ACWA Power in strategic partnership with Dii Desert Energy and the French institute for solar energy CEA-INES, among others. The judging panel recognized the transformative potential of the hydrogen battery. The innovation could create an efficient and flexible infrastructure for H2. The electricity costs for hydrogen production from renewables are very low in Dubai. That’s why ACWA invited us again at the end of 2023 to present our solution locally. That will be extremely exciting.

In November we received two awards at the Global EnergyTech Awards: the prize for the Best CleanTech Solution for Energy and a special prize for Best Stand Out Performer. We were the only winners from Germany. That helps.

Interviewer: Niels Hendrik Petersen

Fig. 5: Thomas Korn

Thomas Korn has been working in the hydrogen field since 1998. The engineer’s experience includes work at BMW on fuel cell development. In 2015, he co-founded the hydrogen startup Keyou in Munich. The startup water stuff & sun was launched in 2017 in Unterschleißheim, Bavaria. The fledgling company now has 15 members of staff and a branch in Uppsala, Sweden.

by Hydrogeit | Mar 7, 2024 | Development, Europe, Germany, News

Interview with Dr. Kai Fischer, Director at RWTH Aachen

The efficient scaling of green hydrogen production technologies is an essential step in making hydrogen an economically sound part of the energy transition. With regard to this necessary and massive capacity expansion, the plastics industry has a lot to offer as far as the hydrogen industry is concerned, because plastics are high-performance materials whose property profile can be engineered very precisely for the intended application. Additionally, the processing technologies in the plastics industry allow high-tech components to be produced efficiently and in large numbers. Dr. Kai Fischer, scientific director at the IKV and responsible for the topic hydrogen economy, explains in this H2-international interview why the exchange between the two industries is so important, what significance plastics have for the scaling of hydrogen technologies, and how the cooperation between the participating industry partners is to be continued in the “Hydrogen Business and Technology Forum”.

Advertisements

H2-international: Following the hydrogen study produced in the past two years, there now is the “Hydrogen Business and Technology Forum” to intensify the exchange between the hydrogen industry and the plastics industry. Why is that now important?

Fischer: Hydrogen is intended to become the backbone of the energy turnaround. Today, approx. 96 % is obtained from fossil resources such as natural gas and coal. Only 4 % is produced by electrolysis. For this – as some people may remember from school – water is broken down into hydrogen and oxygen using electricity. Electrolysis is the way to produce “green”, i.e. climate-neutral, hydrogen. And even for this 4 % electrolysis, only a small proportion of renewable energy is currently being deployed. Consequently, only a very, very small part of the production capacity is at present suitable for producing green hydrogen. Yet all today’s projections are aimed at producing green hydrogen. It is indeed important to see that a great deal needs to be done here with completely new development work. Large numbers of electrolysers and the corresponding infrastructure have to be put in place. That again means working with large numbers, and large numbers are always predestined for plastics. For this reason, we believe that plastics are the enablers to make hydrogen production economically scalable.

And that is why you believe the plastics industry must get together with the hydrogen industry to exchange information and ideas?

Exactly. The people in the hydrogen industry are familiar with all the requirements of the process engineering plants, the media, the temperatures, the pressures etc. But, of course, they think not in plastic but in metal. It is not the case that the construction can simply be switched from metal to plastic. That would not bring any advantages. In order to find new solutions for the requirements of systems, it is necessary to go beyond substituting single metal components with single plastic components, and to look at functional integration. Precisely for this, this application know-how must be communicated so that the plastic value chain can say how solutions would ideally look in plastics.

Are there already examples in the hydrogen industry?

Yes of course. As an example, let us look at the end plates of a fuel cell. Here, many media have to be conveyed, both gaseous and liquid. Connections also have to be integrated. If they are made of metal, it means that a very large number of individual components have to be mounted. In the meantime, there are some applications in which this is solved by a single large injection-moulded part in which all media lines, connections, electronics etc. are already integrated.

This means that the hydrogen industry is not yet aware of the possibilities offered by the plastics industry?

These are two completely different worlds. The facilities for producing or converting hydrogen are classic process engineering plants. They consist predominantly of stainless steel with stainless steel pipes. The producers of such plants are indeed only seldom aware of the possibilities offered by plastics. For this reason it is important to bring the hydrogen OEMs with their knowledge of the requirements together with the plastics specialists with their know-how and their technical capabilities. Only in this way can we start to think in terms of highly integrated products that can be automatically manufactured in very, very large numbers. This is an absolute necessity if the scale-up of green hydrogen technologies is to succeed within a reasonable time and at reasonable cost.

How did the idea of a network forum come about?

The idea of a network forum came because, in 2021, we at IKV launched a market and technology study in cooperation with more than 20 companies in order to deal with this issue holistically. The study is, however, only really the basic package. Our aim was always to operate a continuous exchange to identify how plastics can help in establishing hydrogen. For this, we need continuity, and we have now implemented this in the form of this forum, which will meet regularly twice a year. These meetings will be supplemented by continuous technology monitoring. At the kick-off meeting, we also decided that there would be individual workshops on special topics between the meetings.

What were your impressions of the kick-off meeting and what did you think of the content?

It was a great event! We had a total of 50 participants in the room and four keynote presentations that were divided in equal parts between users of hydrogen systems and solution providers from the plastics value chain. We had very open and transparent discussions. In the breaks, the business cards were flying around and everyone was networking on a grand scale. As part of the event, we also charted the course for defining, according to the requirements, the elements of further cooperation for these two target groups.

As far as the content was concerned, I felt that a very lively demand exists for understanding the systems in the various segments – especially on the part of the plastics industry. I also felt that there are many companies who, irrespective of the competition in their hydrogen systems, are prepared to talk about the challenges because they hope for the push of the open-innovation approach – in other words the push from the supplier industry – and want to create competitive advantages through this in future.

Another aspect that I took from the meeting is that the companies in the plastics value chain, some of which are competing with each other, are very open to cooperation. For example, we discussed the fact that we would sound out in the consortium which testing and characterisation processes are available in which companies so that the companies can supplement each other. In this way, it will also be possible to identify supplementary demands and derive measures to realise them. It was truly noticeable that everyone is keen on baking this large pie together instead of generating competition and trying to grab the biggest slice of a small pie. This seemed to me to reflect the spirit of the meeting generally.

As you said at the beginning, the market and technology study forms the basis for this network. What are the most important things you have taken from this?

The hydrogen industry is still driven very much by traditional process engineering plants. An important finding is, however that we do not have to revolutionise the plastics industry in order to offer solutions to the hydrogen industry. Plastics can be compatible and there are numerous applications and good examples for the implementation of highly integrated and function-integrated components. This means that if the scale-up is necessary and the number of pieces must increase, the plastics industry can offer these solutions without reinventing the world. It is possible to transfer a lot from other industries, but it is naturally not necessary to be familiar with the specific applications in order to be able to suggest suitable solutions for the hydrogen industry. The good news is that we do not now have ten years of development ahead of us and the plastics industry must not fundamentally change or develop completely new products. For each industry it can take what is already there in order to further develop it and transfer it.

What happens now?

Our Forum member Freudenberg held theme workshop in August in addition to our half-yearly meetings to discuss the questions that the Forum participants had addressed fairly openly at the kick-off. The idea for specific workshops was born during the kick-off because the participants deisred an exchange on how to bring plastics expertise specifically into the development of new systems. Furthermore, the team is now starting the Market & Technology Monitor in order to continuously observe the market. We have agreed that it should be more than simply collecting the available information. The information should be questioned, evaluated and categorised. We will look exactly how reliable it is and how realistic the implementation scenarios are. In this way we will draw up an organised list of information, that we will pass on at three-month intervals to the partners in the forum.

Is it still possible to join?

Yes, it is. We naturally want this network to grow, and are pleased to have both small and large companies from the plastics value chain and naturally companies from the hydrogen value chain. Through the synergies of both industries, we can master a scale-up for green hydrogen and make it economical.

Hydrogen Business and Technology Forum

Dr. Kai Fischer leads the „Hydrogen Business and Technology Forum“

With its “Hydrogen Business and Technology Forum”, the Institute for Plastics Processing (IKV) in Industry and Craft at RWTH Aachen University has established a close network between the hydrogen economy and the plastics industry, where it regularly fosters the connection of requirements and application know-how with material and production know-how.

The “Hydrogen Business and Technology Forum” emerged from a market and technology study on plastics in the hydrogen economy initiated by the IKV and completed in November 2022. About 20 industry partners were already involved in the study. With regular workshops and a continuous Market & Technology Monitoring, the work is now being continued in the “Hydrogen Business and Technology Forum”. The kick-off for the Forum was 16 May 2023. The first thematic workshop dealt with “Testing and Analysis of Plastics in Hydrogen Applications” and took place on 9 August 2023 and was hosted by the Forum member Freudenberg. On 19 October 2023 Forum members met again at the IKV for its second regular Workshop. The Forum is still open to new members. Information at H2@ikv.rwth-aachen.de